Chief Financial Officer (CFO) Programme (Modular)

Start Date: Afternoon, August 26, 2026 / Partly Chinese and partly English with sequential Chinese interpretation

Venue: Shanghai,Beijing,Shenzhen

Participants

The programme is designed for the CEO’s partners, including the CFO, Finance Director or other financial executives with similar responsibilities to the organization’s top decision-maker. Participants should have at least eight years’ experience in middle to senior financial management. The programme also equips board members with the financial expertise they need to make better strategic decisions.

Introduction

As companies grow rapidly and become more capital-intensive, CFOs have moved beyond their traditional role as chief accountant to oversee business operations and participate in strategy execution. As experts in financial activities, they focus on gaining insight into their operating model, assessing whether a strategic plan is aligned with their long-term vision, and weighing the risks and rewards to steer the company towards sustainable growth. As a result, it is imperative for CFOs to enhance their knowledge and skills. The CEIBS CFO Programme is designed to quickly develop CFOs into key strategic partners of the CEO by equipping them with general knowledge and strategic thinking. The programme covers a wide range of topics including macroeconomic analysis, financial statements and disclosure, corporate capital management and integration of industry and finance, tax management, mergers and acquisitions (M&A), corporate ESG and leadership development.

Programme Coverage

- Module 1: CFO Leadership Excellence

- Module 2: Financial Control and the Macro Economy

- Module 3: Taxation and Corporate ESG

- Module 4: Finance and Strategy: The CFO’s Perspective

- Module 5: Financial Statements and Business Innovation

- Module 6: M&A

- Module 7: Navigating the AI Era: The New Business Landscape and the CFO’s Management Approach

A certificate of completion will be awarded.

Gain membership in the CEIBS Alumni Association. Learn More

Contact Us

China Europe International Business School

Address: 699 Hongfeng Road, Pudong,

Shanghai, 201206, P.R.C.

Telephone: (86 21) 2890 5300

Mobile: (86) 139 0173 8667

Email: xtina@ceibs.edu

-

Su, XijiaProfessor Emeritus, CEIBS

Su, XijiaProfessor Emeritus, CEIBS

Programme Co-Director of Chief Financial Officer (CFO) Programme

Programme Co-Director of CEIBS Venture Capital Camp -

Zhang, FeidaAssociate Professor of Accounting, CEIBS

Zhang, FeidaAssociate Professor of Accounting, CEIBS

Programme Co-Director of Chief Financial Officer (CFO) Programme -

Xu, DingboProfessor inAccounting, CEIBS

Xu, DingboProfessor inAccounting, CEIBS

Essilor Chair in Accounting;

Associate Dean -

Ding, YuanProfessor of Accounting;

Ding, YuanProfessor of Accounting;

Cathay Capital Chair in Accounting, CEIBS

Programme Director of Globalisation of Chinese Companies in the New Era -

Huang, ShengProfessor of Finance;

Huang, ShengProfessor of Finance;

Associate Dean;

Director of EMBA Programme;

Director of CEIBS Research Center for Corporate and Capital Markets, CEIBS

Programme Director of Corporate Capital Management Programme -

Zhang, YuProfessor of Strategy;

Zhang, YuProfessor of Strategy;

Department Chair (Strategy and Entrepreneurship), CEIBS

Co-Director,CEIBS Centre for Innovation and Entrepreneurship

Programme Co-Director of CEIBS Venture Capital Camp -

Wang, An-Chih AndrewAssociate Professorof Management, CEIBS

Wang, An-Chih AndrewAssociate Professorof Management, CEIBS

Programme Co-Director of Leadership Development Programme -

Yang, WeiAssociate Professor of Management, CEIBS

Yang, WeiAssociate Professor of Management, CEIBS -

Wu, HoweiAssistant Professorof Economics, CEIBS

Wu, HoweiAssistant Professorof Economics, CEIBS -

Bai, GuoAssistant Professorof Strategy and Entrepreneurship, CEIBS

Bai, GuoAssistant Professorof Strategy and Entrepreneurship, CEIBS

-

Tse, KalunVisiting Professor, CEIBS

Tse, KalunVisiting Professor, CEIBS -

Mao, FugenVisiting Professor, CEIBS

Mao, FugenVisiting Professor, CEIBS -

Ju, MingVisiting Professor, CEIBS

Ju, MingVisiting Professor, CEIBS

Programme Objective

The most notable change in the role of the CFO is the shift from simply controlling financial processes to becoming more involved in business operations. The Programme is designed to provide participants with the skills and effective tools they need to navigate this changing role.

Programme Benefits

By the end of the Programme, participants will be able to:

- Think outside the box and broaden their strategic vision.

- Improve their financial analysis and planning skills.

- Create value for their company through value-based management.

- Help their company build and maintain a strong public reputation, especially with investors and shareholders.

- Leverage financial data and models to drive their company’s digital transformation.

- Make better use of resources to maximize financial performance.

- Help design a robust performance evaluation system for strategy execution.

- Become CEIBS alumni and participate in a variety of alumni events organized by the CEIBS Alumni Association.

Programme Schedule

The Programme consists of seven modules:

Module 1: CFO Leadership Excellence

- Leadership mindset and skills

- Employee motivation

- Team psychology and performance management

- Classical and modern theories of leadership

Module 2: Financial Control and the Macro Economy

- Strategic cost management

- Group financial control

- Total budget management

- Recognizing the new characteristics of the global economy

- Interpreting the development of macroeconomic policies

- Prospects for China’s economy

Module 3: Taxation and Corporate ESG

- Analysis of trends in tax regulation of equity transactions

- Tax risk in equity structuring and tax planning

- Corporate ESG

- Carbon accounting and corporate strategy

- Driving energy transition through financial innovation

Module 4: Finance and Strategy: The CFO’s Perspective

- The strategic nature of corporate finance

- Building competitive advantage through financial activities

- Financial and strategic analysis

- Driving growth through management

- Strategic management from a financial perspective

Module 5: Financial Statements and Business Innovation

- nterpreting financial statements

- Financial disclosure and investor relations

- Innovation incubation and feasibility analysis

- Innovation and business design

- Innovation and macroeconomic and social systems

Module 6: M&A

- The Evolution and Dynamics of China’s Capital Market

- Strategic Formulation and Rationale in Corporate M&A

- The Transaction Process: Key Elements and Critical Phases

- Designing M&A Transaction Structures

- Post-Merger Integration: Key Considerations

Module 7: Navigating the AI Era: The New Business Landscape and the CFO’s Management Approach

- Audit and internal control

- Development of AI

- Competitive landscape in AI

- Business impact of cutting-edge technologies

Programme video

[video] International Balance of Payment and Future Competition in China

Note: Please make sure you have Windows Media Player installed on your computer to view the videos.Teaching Language

Partly Chinese, partly English with sequential Chinese interpretation

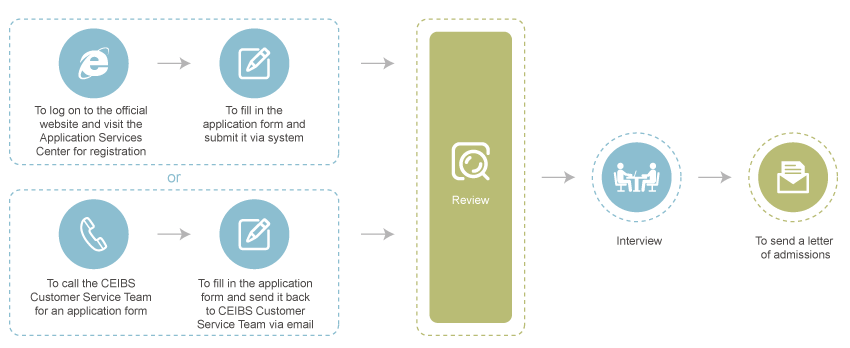

Admissions Procedures

Applications are requested at least 30 days before the programme start date. Applications are reviewed as they arrive and admissions are subject to the final confirmation of CEIBS. Any applications received after that date will be considered on the basis of space availability. For more information, please contact our Customer Service Team in Shanghai, Beijing or Shenzhen.

Cancellations

Any cancellation made 30 days or more prior to the programme start date is eligible for a full refund of programme fees paid. However, the expenses arising therefrom shall be for the account of the applicant or his/her employer. Any cancellation made less than 30 days prior to the programme start date shall be subject to a fee of 20 percent of the total programme fee. After the programme starts, no fees shall be refunded for participants who withdraw from the programme for any reason.

Notification

To ensure the continuity of your learning, you are required to make proper arrangements according to the course schedule after receiving your letter of enrollment. We will neither make up lessons for you nor confer you with the certificate of completion if you are absent from the course for personal reasons. CEIBS reserves the right to amend information on this programme including price, discount, date, location, faculty, daily schedule and other details.