Corporate Capital Management Programme (Modular)

Start Date: Afternoon, October 15, 2026

Venue: Shanghai/Beijing/Shenzhen

Participants

The programme is designed for all companies with capital management needs, including those with financing needs, IPO candidates, and public companies. Typical participants include company founders, partners, and corporate decision-makers responsible for mergers and acquisitions and strategic investments, as well as senior executives such as chief financial officers, board secretaries and investor relations directors.

Introduction

With the introduction of the registration-based IPO system, the launch of the STAR Market and the establishment of the Beijing Stock Exchange, China’s multi-tiered capital market system provides companies with easy access to capital markets. But when it comes to securitising corporate assets, how should companies plan their financing and IPO efforts? How should they prepare for the IPO process from a financial, legal and auditing perspective to avoid the risk of non-compliance? As the continued expansion of capital markets has brought changes to the market ecosystem, how should listed companies keep abreast of market dynamics and manage investor relations effectively to continually attract market attention, resources and funding

Chinese companies operating under the traditional model got off to a flying start, fuelled by China’s rapid economic growth. However, increasing competition and market saturation in China and abroad have resulted in an industry shakeout. As these companies face bottlenecks, how can they conduct M&A and capital operations across the supply and industry chains to drive the integration of industry and finance, enhance their core competencies, and take giant leaps forward?

The CEIBS Corporate Capital Management Programme is tailored for strategically minded Chinese business leaders in pursuit of breakthroughs. The programme sheds light on the essence of investment and financing required for capital management throughout a company’s lifecycle, and the key to asset securitisation and capital appreciation. It aims to equip participants with the big-picture perspective and resource integration skills needed to navigate the ever-changing business world and drive rapid, healthy business development through efficient capital management. In addition to CEIBS professors, prominent academics from China and abroad as well as industry professionals are invited to teach. The Programme focuses on core capital management issues, including the architecture of China’s financial investment market, global capital markets and IPO practices, the logic of investment, and information disclosure and investor relations management of listed companies. To enable companies to move forward effectively, the programme provides insights on how to select the most appropriate investment and financing instruments for M&A or VC investment at different stages of growth based on corporate strategy.

Programme Coverage

- Module 1: Comprehensive Insights into Economic Trends and Capital Markets

- Module 2: Financial Statement Interpretation and Information Disclosure

- Module 3: Enterprise value, ESG and M&A (1)

- Module 4: Innovation in the new economy, corporate governance, and risk management

- Module 5: Value investment and the integration of industry and finance

- Module 6: China’s economic trends, medium- and long-term capital market development, and M&A (2)

A certificate of completion will be awarded.

Gain membership in the CEIBS Alumni Association. Learn More

Contact Us

China Europe International Business School

Address: No.20, Zhongguancun Software Park,

8 Dongbeiwang West Road,Haidian District, Beijing, 100193, P.R.C.

Telephone: (86 10) 8296 6686

Mobile: (86) 185 1056 1225

Email: wamy3@ceibs.edu

-

Huang, ShengProfessor of Finance;

Huang, ShengProfessor of Finance;

Associate Dean;

Director of EMBA Programme;

Director of CEIBS Research Center for Corporate and Capital Markets, CEIBS

Programme Director of Corporate Capital Management Programme -

Chen, JiepingProfessor Emeritus, CEIBS

Chen, JiepingProfessor Emeritus, CEIBS -

Cheng, LinProfessor of Accounting;

Cheng, LinProfessor of Accounting;

Department Chair (Finance and Accounting),CEIBS -

Gong, YanProfessor of Entrepreneurial Management Practice, CEIBS

Gong, YanProfessor of Entrepreneurial Management Practice, CEIBS

Director,CEIBS Centre for Innovation and Entrepreneurship

Programme Director of CEIBS Entrepreneurial Leadership Camp -

Lan, XiaohuanProfessor of Economics, CEIBS

Lan, XiaohuanProfessor of Economics, CEIBS -

Su, XijiaProfessor Emeritus, CEIBS

Su, XijiaProfessor Emeritus, CEIBS

Programme Co-Director of Chief Financial Officer (CFO) Programme

Programme Co-Director of CEIBS Venture Capital Camp -

Rui, MengProfessor of Finance and Accounting;

Rui, MengProfessor of Finance and Accounting;

Parkland Chair in Finance;

Associate Dean (PhD);

Director of CEIBS Centre for Wealth Management;

Co-Director of CEIBS Centre for Family Heritage

Programme Director of Family Office Diploma Programme -

Xu, BinProfessor of Economics and Finance, CEIBS

Xu, BinProfessor of Economics and Finance, CEIBS

Wu Jinglian Chair Professor in Economics -

Zhang, HuaAssociateProfessor of Finance, CEIBS

Zhang, HuaAssociateProfessor of Finance, CEIBS -

Zhang, FeidaAssociate Professor of Accounting, CEIBS

Zhang, FeidaAssociate Professor of Accounting, CEIBS

Programme Co-Director of Chief Financial Officer (CFO) Programme

-

Tse, KalunVisiting Professor, CEIBS

Tse, KalunVisiting Professor, CEIBS

Programme Objective

Focusing on core capital operations issues, the programme is designed to enable corporate decision-makers or executives responsible for strategic investment/financial management to drive the integration of industry and finance. The Programme is a combination of classroom instruction, lectures by academics or practitioners in the field of capital management, and group-based case discussions. It sheds light on the essence of corporate capital management and equips participants with the big-picture perspective and resource integration skills needed to drive robust business development through efficient capital management.

Programme Benefits

The programme will enable participants to:

- Cultivate the mental skills essential to managing capital in a complex economic environment.

- Understand the theoretical framework for corporate capital management decision-making and gain hands-on experience.

- Learn about China’s progress in the integration of industry and finance and financial innovation, as well as the hidden problems.

- Gain insights into global capital markets and IPO practices.

- Familiarise themselves with the disclosure policies and practices of listed companies and promote sound investor relations.

- Improve their M&A planning capabilities based on the corporate strategy.

- Learn how to select appropriate investment and financing instruments based on corporate strategy.

- Learn about and apply the latest concepts in supply chain finance and industry chain finance.

- Collaborate with outstanding practitioners in capital operations and management in China to build a platform for resource sharing and lifelong learning.

- Become part of the vibrant CEIBS alumni community.

Programme Schedule

The ten-month Programme consists of six modules and is taught by a team of leading professors and academics in the field of capital management research and practice, as well as industry leaders. The Programme focuses on the strategies and skills needed to manage capital through the stages of a company’s growth. It also explores capital operations from multiple perspectives, enabling participants to create more value for their organisations.

Module 1: Comprehensive Insights into Economic Trends and Capital Markets

- Understanding economic challenges and emerging trends in China

- An overview of corporate capital management

- Exploring corporate capital structure and financing solutions

- Global capital markets and the securitisation of Chinese companies

- Analyzing the dynamics of China’s capital market ecosystem

- Key considerations in IPO decision-making processes

- Effective market capitalization management for listed companies

Module 2:Financial Statement Interpretation and Information Disclosure

- Gaining insights into corporate health through financial statements

- The role of information disclosure in capital markets

- Early risk warning

Module 3: Enterprise value, ESG and M&A (1)

- Business development strategies and methods for assessing enterprise value

- ESG principles and the rise of green finance

- M&A: strategic planning, execution steps and critical success factors

- Valuation techniques and value creation in M&A transactions

Module 4: Innovation in the new economy, corporate governance, and risk management

- Exploring innovation trends and future prospects in the new economy

- Corporate governance structures and best practicesAdopting a forward-looking, global, and holistic approach to corporate governance

- Enterprise risk management and internal control systems

Module 5: Value investment and the integration of industry and finance

- The critical role of information mining in decision-making

- Leveraging data mining for value investment strategies

- Essential financial concepts and tools driving industrial development

- Financial instruments as drivers of competitive advantage in industry

Module 6:China’s economic trends, medium- and long-term capital market development, and M&A (2)

- China’s economic growth in the global context

- Analysis and forecast of medium- and long-term capital market development post-registration-based IPO system implementation

- Trends in friendly and hostile mergers involving large equity and controlling interests

- M&A implementation: strategy development, transaction structure design and post-M&A integration

Teaching Language

Partly Chinese, partly English with sequential Chinese interpretation

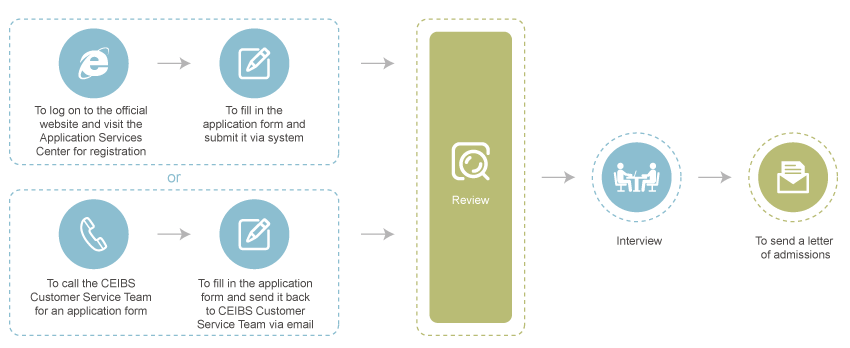

Admissions Procedures

Applications are requested at least 30 days before the programme start date. Applications are reviewed as they arrive and admissions are subject to the final confirmation of CEIBS. Any applications received after that date will be considered on the basis of space availability. For more information, please contact our Customer Service Team in Shanghai, Beijing or Shenzhen.

Cancellations

Any cancellation made 30 days or more prior to the programme start date is eligible for a full refund of programme fees paid. However, the expenses arising therefrom shall be for the account of the applicant or his/her employer. Any cancellation made less than 30 days prior to the programme start date shall be subject to a fee of 20 percent of the total programme fee. After the programme starts, no fees shall be refunded for participants who withdraw from the programme for any reason.

Notification

To ensure the continuity of your learning, you are required to make proper arrangements according to the course schedule after receiving your letter of enrollment. We will neither make up lessons for you nor confer you with the certificate of completion if you are absent from the course for personal reasons. CEIBS reserves the right to amend information on this programme including price, discount, date, location, faculty, daily schedule and other details.