Dual circulation still a top priority for China's development

By Ding Yuan and Serena Cui

In 2022, as growth of the global economy slowed, consumer spending also played a diminishing role as the bedrock for the China’s economy. The country’s sluggish domestic circulation is the result of tightened COVID-19 control measures which have made it difficult to unleash domestic demand. Moreover, it is only by removing obstacles down the road that China can ensure a stable and healthy domestic circulation and greater economic vitality.

The term “dual circulation” refers to a new economic development pattern in which China’s domestic market remains the mainstay and in which domestic and international markets reinforce each other.

Driven by this paradigm, China was the only economy in the world with positive economic growth in 2020, and it continued to maintain a strong GDP growth rate of 8.1% in 2021.

However, after the first quarter of 2022, China’s economy took a sharp turn, and by October, the country’s composite Purchasing Managers’ Index (PMI), manufacturing PMI, and non-manufacturing PMI had all contracted, indicating a downward trend in its economic growth.

So, why has the Chinese economy plunged from the top of the world to its second-lowest point on record in the past 40 years? And, what are the challenges ahead?

Barometers for economic circulation

Several indicators are crucial to implementing the dual circulation strategy.

First, logistics plays a key role in smooth circulation. China’s domestic circulation and economies of scale are made possible by its strong industrial foundation, comprehensive industry chains and huge market; however, the links in economic operations – from production to distribution to consumption of goods – have to be connected by logistics.

Statistics from the China Federation of Logistics & Purchasing reveals that, in the first three quarters of 2021, China’s logistics sector increased by 11.4% year on year to 234.5 trillion RMB. The manufacturing industry was the main driving force in the industrial logistics recovery, up by 12.5% year-on-year. In particular, logistics for equipment manufacturing and high-tech manufacturing climbed 16.2% and 20.1%, respectively.

As consumers gradually resumed purchasing, logistics for organisations and residents increased by 13.8% year-on-year. This trend also benefited logistics companies, which saw their revenues grow by 35.1% and profits by 46.1% on a yearly basis.

China’s robust domestic market also facilitated its international circulation. In the first three quarters of 2021, 11,300 China-Europe freight trains transported a total of nearly 1.1 million containers of commodities, up 29% and 37% respectively. Cargo throughput at China’s ports also totalled nearly 11.6 billion metric tonnes, up 8.9% year-on-year.

Second, smooth domestic circulation also hinges on the wellness and the development of smaller, self-run businesses which serve as the ‘capillaries’ and ‘nerve endings’ of industrial and supply chains.

Official statistics revealed that by the end of 2021, China had 103 million small businesses, representing two-thirds of the country’s total market players. Amongst them, 19.7 million businesses were set up in 2021, up 17.2% year-on-year (making up 68.2% of new market players).

Culture, sports and entertainment, scientific research and technical services, information transmission, software and IT services saw the greatest growth in new self-run businesses in 2021. Meanwhile, around 29.5 million were engaged in new technologies, new industries, and new forms and models of business by the end of 2021, nearly 7.8 million of which were set up in 2021, up 29.3% year-on-year.

The resilience of big companies is built upon their substantial economic and organisational resources which provide them stronger capabilities in mitigating risks. However, China cannot reach its socio-economic dynamism and vitality without the contribution of the vast number of self-run businesses. To fully unleash their potential, a favourable business environment is needed to help them cope with uncertainties.

Lastly, business and consumer confidence is another useful indicator of economic circulation.

In the first three quarters of 2021, China’s airlines, railways, and roads operated normally, enabling people to travel around the country for business trips, to attend school, seek employment, and visit relatives. At the same time, local leisure trips, short-distance tourism, rural tours, and night tours also emerged as new growth opportunities.

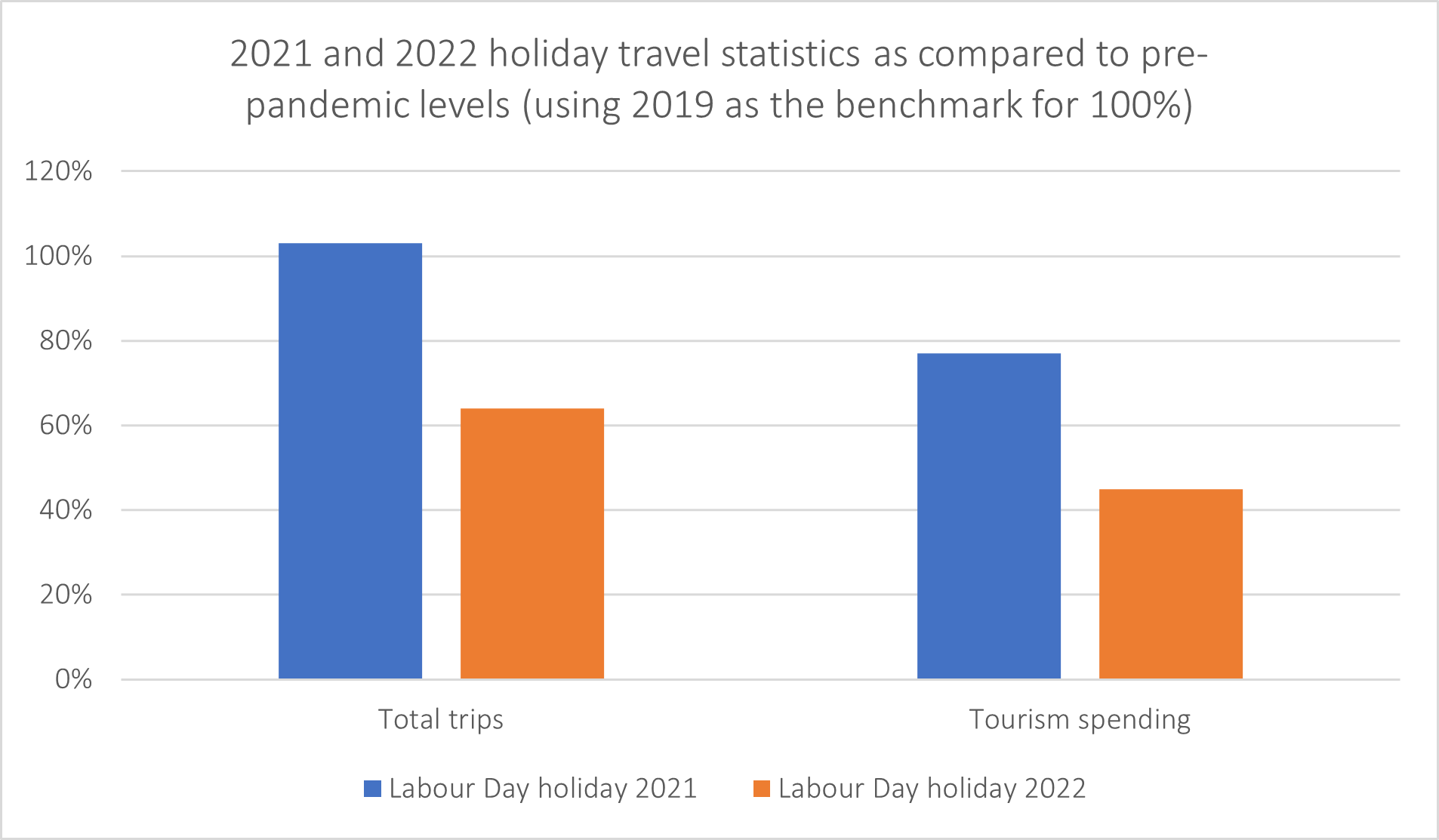

An important turning point in China’s travel recovery over the past two years was the five-day Labour Day holiday in 2021, when Chinese tourists made around 230 million domestic trips and generated over 113.2 billion RMB in tourism revenue, injecting confidence into the development of the industry.

It is also worth noting that as global consumers shifted spending from services to goods, China’s exports soared in 2020 and 2021. Meanwhile, China’s domestic retail consumer goods sales totalled 31.8 trillion RMB in the first three quarters of 2021, up 16.4% year-on-year.

Notably, at that time, China’s ‘Zero COVID’ policy played an important role in providing a relatively safe and less disrupted business environment. As result, the country was able to successfully stimulate its domestic market and adopt innovative approaches to facilitating production, distribution, circulation, and consumption in economic operations. A variety of measures were also introduced to open up the market to the outside world so that domestic and international circulation could reinforce each other.

Obstacles to domestic circulation

The above mentioned achievements spoke volumes about the effectiveness of the dual-circulation strategy, which allowed China to adapt to changes in the global landscape and seek new areas of growth. It was also a natural choice for the country as it evolved from a major economy to a strong economic power. In 2022, however, China’s economic situation changed.

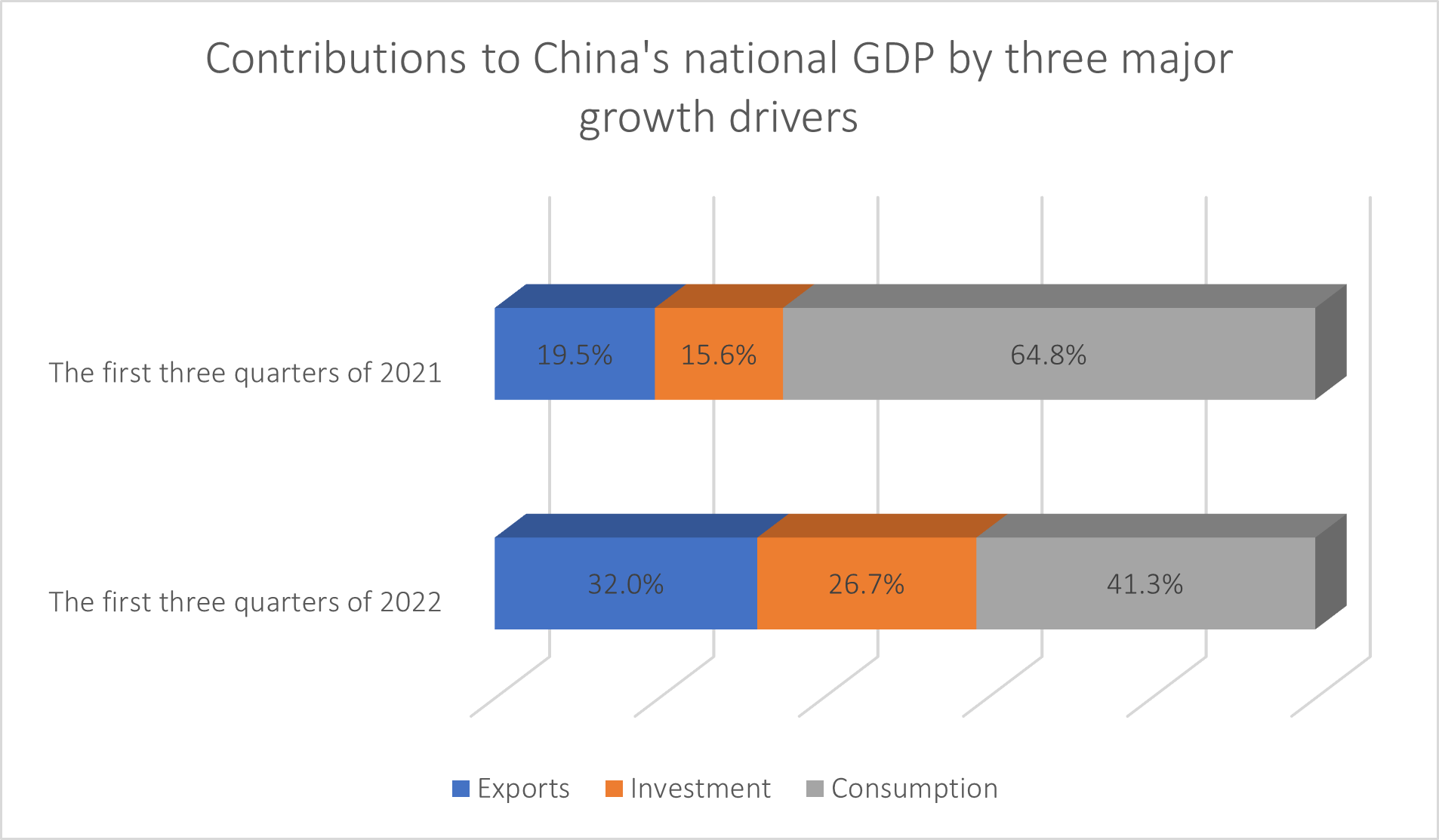

In the first three quarters of 2022, China’s net exports of goods and services contributed 32% of the country’s economic growth, and gross capital formation accounted for 26.7% of its GDP, 1.7 times higher than the level in the previous year.

This means that China’s final consumption expenditure played a diminishing role as the bedrock for its economy, as its contribution to the national GDP in the first three quarters dropped from 64.8% in 2021 to 41.3% in 2022.

On closer inspection, China’s exports of mechanical and electrical products grew by 10%, while labour-intensive products grew by 12.7%, making them the two biggest sectors in terms of export growth in the first three quarters of 2022.

If this trend were to continue, it would pose setbacks to the supply-side reform started in 2015, through which China took pains to cut overcapacity, reduce excess inventory, and upgrade industries.

It would even undermine the dual-circulation system aimed at “selling products where they are produced and producing them where they are sold.” In other words, while external circulation has continued to run (albeit not quite in the desired direction), internal circulation has been blocked.

Let us take a deeper look at the reasons behind this by reviewing the key indicators of economic circulation in 2022.

First, the logistics sector. In the first three quarters of 2022, China’s total social logistics grew by 3.5% year-on-year, with both industrial and residential consumption declining compared with 2021.

Amongst transport companies, rail and water transport companies had fairly stable revenues, while road transport firms saw declining revenue. From January to August, many logistics businesses recorded negative profits, for they had to pay a cost of 91.1 RMB for every 100 RMB earned.

In 2022, China-Europe rail freight continued to operate, but shipment grew only 7%, a far cry from the growth rate of 30% in 2021. Meanwhile, port cargo throughput remained roughly the same as the previous year, with no significant increase. The obstructed flow of local logistics has affected both domestic and international circulations.

From the viewpoint of market players, although there has been an increase in the number of self-run businesses, they have been confronted by a myriad of challenges in terms of operating costs, business premises, recruitment and financing.

According to Chinese business media outlet Caixin, since 2022, nearly 80% of self-run businesses have earned an average monthly revenue of less than 10,000 RMB, with nearly 60% mired in losses. From January to August 2022, the number of new self-run businesses increased 6% year-on-year – lower than the average growth rate of 10.8% over the past decade – and the number of exits rose 9.5% compared to the same period in 2021.

Self-run businesses are mostly concentrated in the wholesale and retail sectors, followed by accommodations and catering, convenience services, repairs and other services. And nearly 70% of them provide offline services.

As such, these businesses were often forced to shut down as a result of the COVID-19 pandemic, which affected people’s everyday lives and took a toll on employment and economic growth.

In spite of relief measures such as tax cuts, frequent lockdowns made it impossible to maintain business as usual and favourable policies were introduced often to no avail. Moreover, business and consumer confidence dropped to a low level and has remained gloomy almost throughout the year.

In the first three quarters of 2022, the number of domestic trips plunged by 22.1% to less than 2.1 billion, and tourism spending shrank 27.2% year-on-year. The number of trips and tourism revenue during the Labour Day holiday in 2022 were only 64% and 44% of pre-pandemic levels, respectively.

The gloom in the tourism industry has also led to a decrease in transportation revenues. In the first three quarters of 2022, China’s high-speed railways reported a net loss of 94.7 billion RMB, surpassing combined losses in 2020 and 2021.

Luxury giants LVMH, Kering and Richemont, which remained bullish on the Chinese market and raked in much higher sales in China than in other regions in 2020 and 2021, suffered nearly double-digit revenue drops in China in 2022.

China Duty Free Group, the country’s largest duty-free business, also reported a 20.5% year-on-year drop in revenue and its net profits attributable to shareholders was nearly cut by half in the first three quarters of 2022.

In addition to the sluggish demand of upper-class consumers, China’s middle class has also tightened its belt. Official statistics showed that in the first three quarters of 2022, the per capita consumption expenditure of urban residents was 22,385 RMB, a nominal increase of 1.8% over the previous year. However, after deducting price factors, it actually fell by 0.2%.

Although per capita consumption of food and accommodation, household goods, transportation and communication, and health care increased, consumption of clothing decreased by 1.1%, while that of education, culture and recreation fell by 4.2%.

In short, it is fair to say that China’s obstructed domestic circulation is a result of tightened COVID-19 control measures, which have made it difficult to unleash domestic demand. This weakened domestic circulation has had a greater bearing on China’s economy than any external factor.

Consider Chinese Vice Premier Liu He’s comments in People’s Daily on November 4: “China can leverage its huge market size to stabilise and expand domestic circulation and drive international circulation. We should take effective measures to unleash domestic demand, build a unified nationwide market and break down obstacles to domestic circulation to ensure a medium level of circulation can be achieved under extreme circumstances.”

In terms of international circulation, in the first three quarters of 2022, China’s economy continued to grow at 3.9% by virtue of its exports and increased investment in infrastructure and manufacturing. By October, however, the country’s exports contracted for the first time since the early days of the pandemic.

“There has been a shift in overseas consumer preferences, and the decline in goods consumption has reduced demand for Chinese product exports,” Chief Economist at investment bank Guotai Junan International Zhou Hao states.

Moreover, the International Monetary Fund has lowered the 2023 global growth forecast to 2.7%, and predicts that countries accounting for one-third of the global economy will likely to contract this year or next.

In times like this, it is imperative to expand domestic demand and turn domestic circulation into a strong growth engine, while strengthening international exchanges to facilitate external circulation.

The fifth China International Import Expo held in Shanghai on November 4 was attended by 284 of the world’s top 500 companies and industry leaders, outnumbering the figure in 2021, nearly 90% of which were regular exhibitors.

However, the CIIE can only give full play to its spill-over effects when China’s economy is circulated to stimulate businesses’ investment capacities and restore confidence amongst consumers.

Smooth economic circulation will give us much-needed levers to expand domestic demand and unleash untapped market potential. It will also allow China to advance its high-level opening-up, share with other countries the opportunities presented by its sizable market, and maintain mutually beneficial interaction with the international community.

In a nutshell, only when we remove various obstacles that hinder China’s healthy domestic circulation can we lay a solid foundation for the country’s economic growth, and promote the dual circulation of domestic and international markets.

Ding Yuan is Vice President and Dean, Cathay Capital Chair Professor in Accounting at CEIBS. For more on his teaching and research interests, please visit his faculty profile here. Serena Cui is a Research Fellow at CEIBS.