How have COVID-19 lockdowns changed consumer behaviour?

By Wang Qi

Recent developments have given fresh hope that we are close to the end of the pandemic, but we are not there yet. Nearly three years since the outbreak of COVID-19, how have people’s savings and consumption psychology changed in the wake of lockdowns? Has COVID-19 brought a “new normal” to spending habits? And, what differences exist in consumer behaviour between outbreak and non-outbreak areas? To answer these questions, we conduct a two-year series of surveys of 5,000 consumers focused on consumer income and savings, sustainable consumption, experiential consumption, niche interests and consumption of new technologies.

Increased savings to prepare for future uncertainties

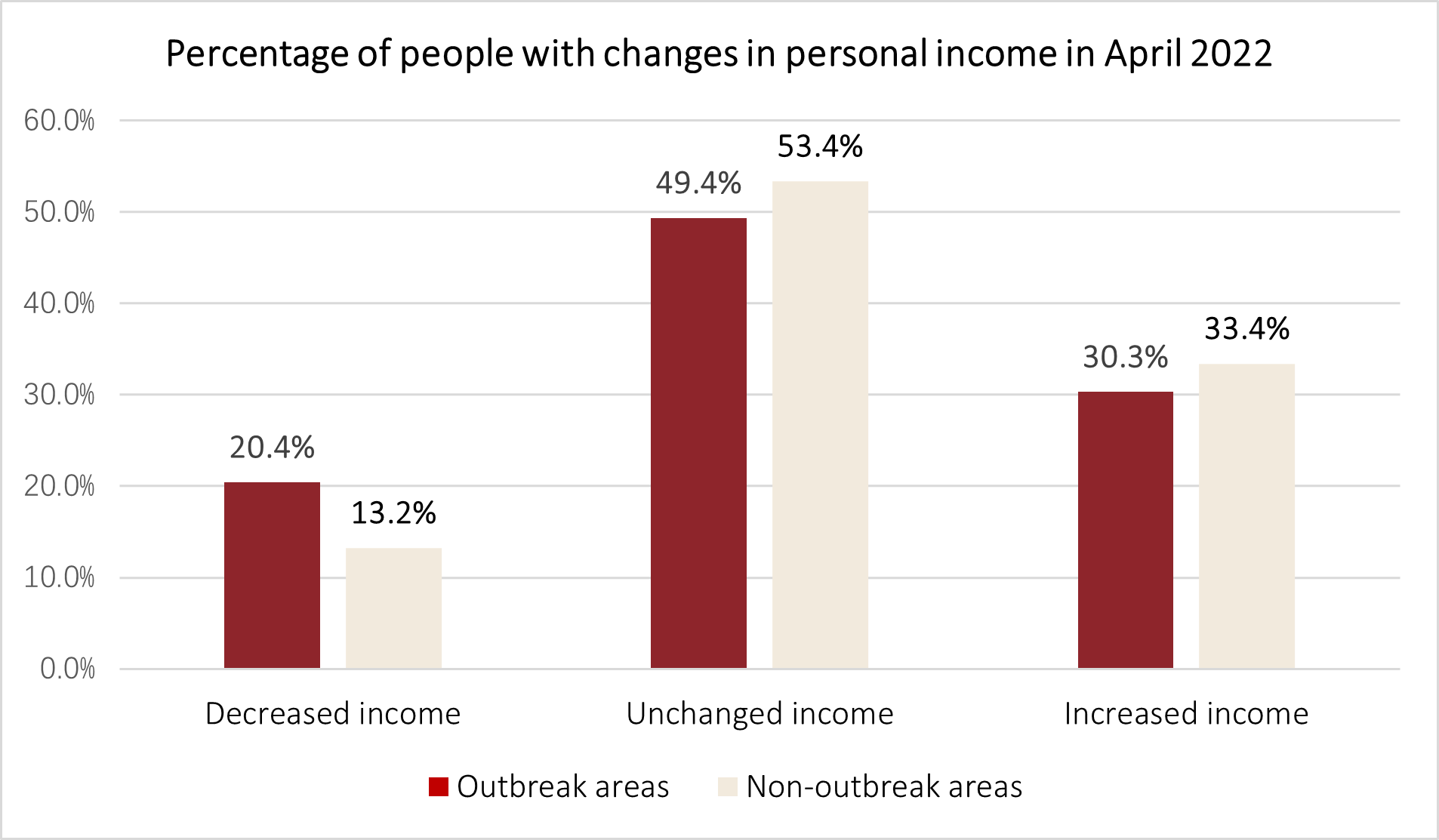

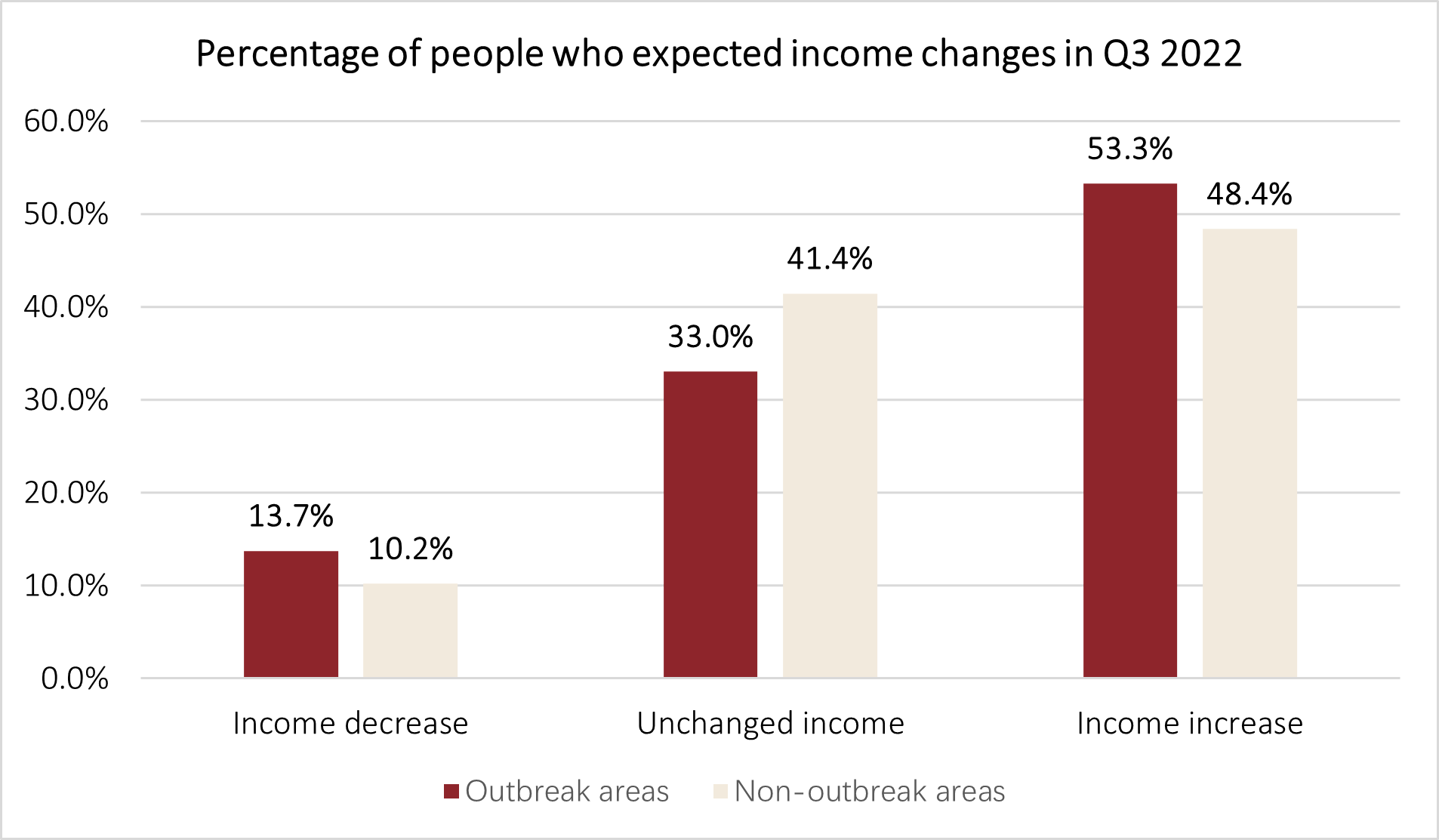

A survey we conducted in earlier this year shows that 30.3% of people living in COVID outbreak regions reported an increase in personal income, compared with 33.4% in non-outbreak areas. The percentage of people who saw a decrease in personal income was significantly higher than in non-outbreak areas, at 20.4% and 13.2%, respectively.

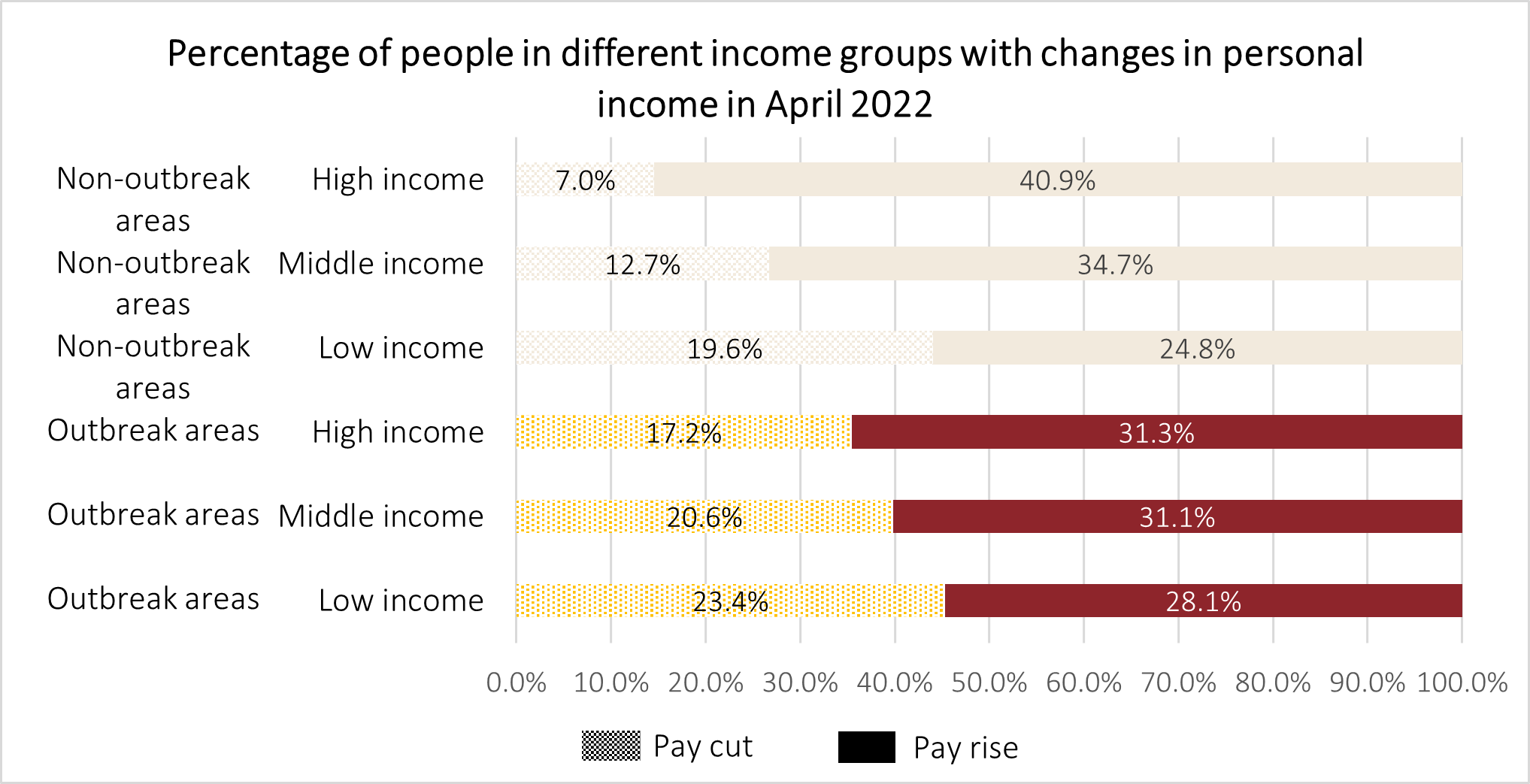

In all income groups, the population with reduced income was significantly larger in outbreak areas than in non-outbreak areas. In both areas, the higher the income, the higher the percentage of income increase; the lower the income, the higher the percentage of income decrease. To summarise, those with lower monthly income were hit harder by COVID-19 than those in high-income groups.

Note: Low income is no more than 5,000 RMB per month; middle income is 5,001-10,000 RMB per month; and high income is more than 10,000 RMB per month.

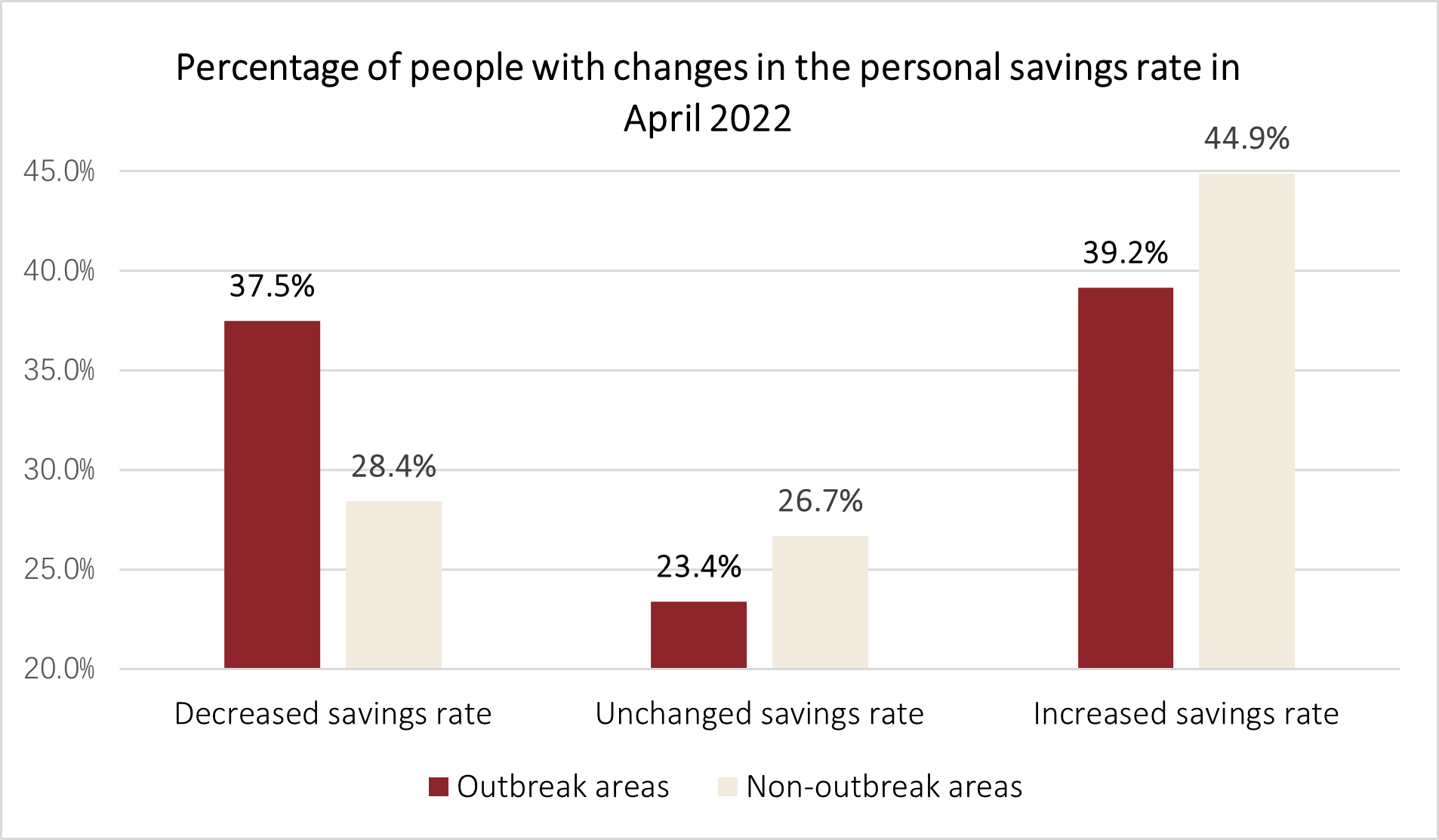

In terms of changes in savings rates (i.e., the proportion of total savings as a percentage of total income) in April, the population with an increased savings rate in outbreak areas is smaller than that in non-outbreak areas, while the population with decreased savings rate is bigger than that of non-outbreak areas during the same period. This is partly because, in outbreak areas, people’s income declined during the lockdown.

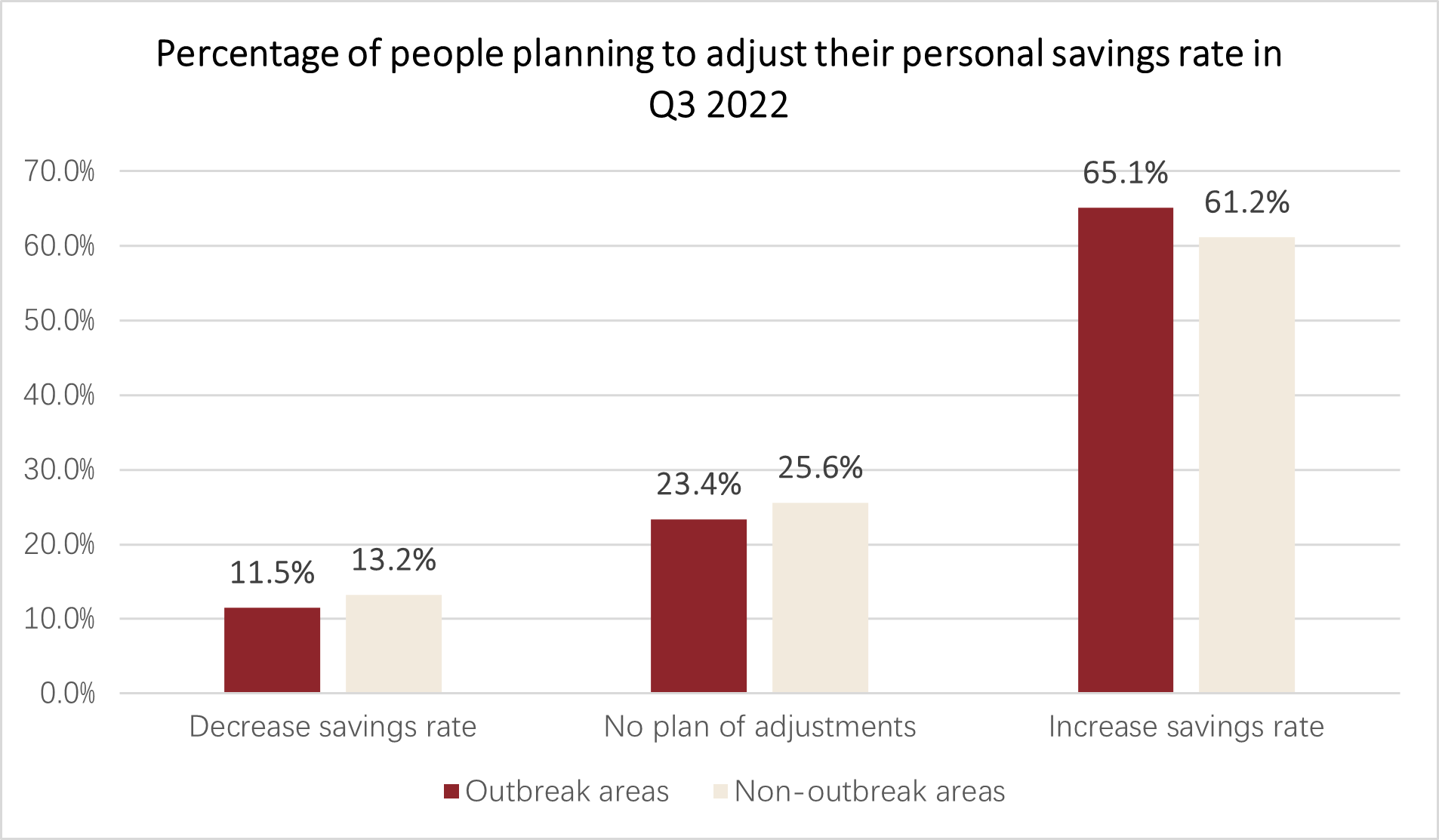

Nearly 65% of respondents also reported a higher estimated savings rate in the third quarter of 2022. More people also stated they wish to increase their savings rate in outbreak areas than in non-outbreak areas. This indicates that people are inclined to accumulate more savings to prepare for future uncertainties.

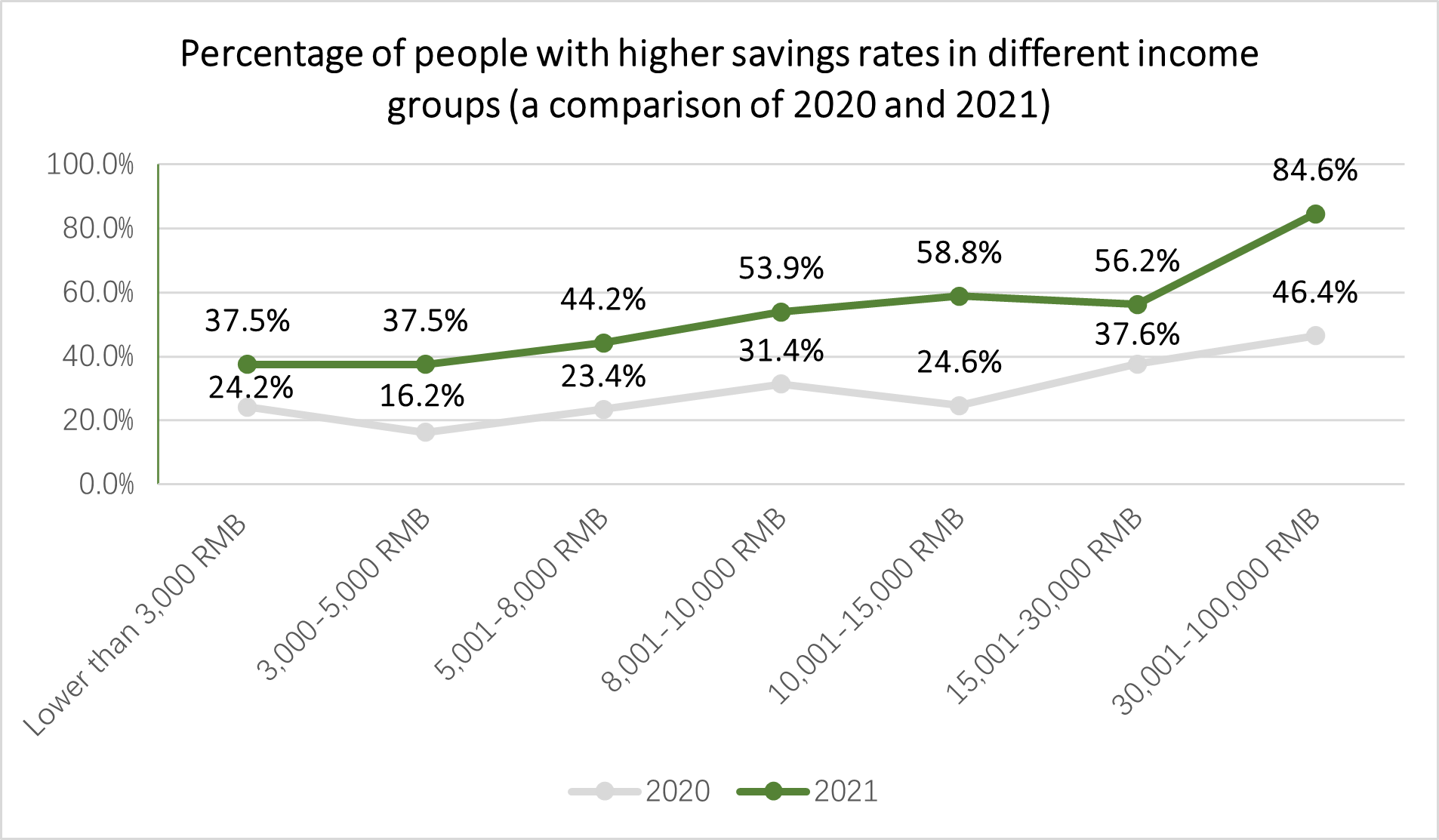

Our survey shows that, in 2021, the percentage of respondents with an increased savings rate was significantly higher than 2020 (at 47.4%). It also suggests that the higher the income group, the higher the percentage of people with a bigger savings ratio. This indicates that consumers’ appetite for consumption has weakened significantly, a trend that has become more prominent since this April. Thus, we have to contemplate how to rebuild consumer confidence in the coming year.

While COVID-19 has further widened the income gap between rich and poor, consumers are accumulating more savings to prepare for future uncertainties.

Although people’s income shrank in April this year, most were optimistic about the third quarter situation, with nearly 50% of respondents expecting increased income in Q3.

Lockdown policies boost “stay-at-home economy”

Residents in many COVID-19 outbreak areas could only stay at home during lockdowns. They thus jumped into group buying to stay fed during these periods. In April, 87.5% of people living in COVID-affected areas purchased groceries through group buying. The percentage of people who positively regard group buying is 81.2% in outbreak areas, higher than the 75.7% in non-outbreak areas.

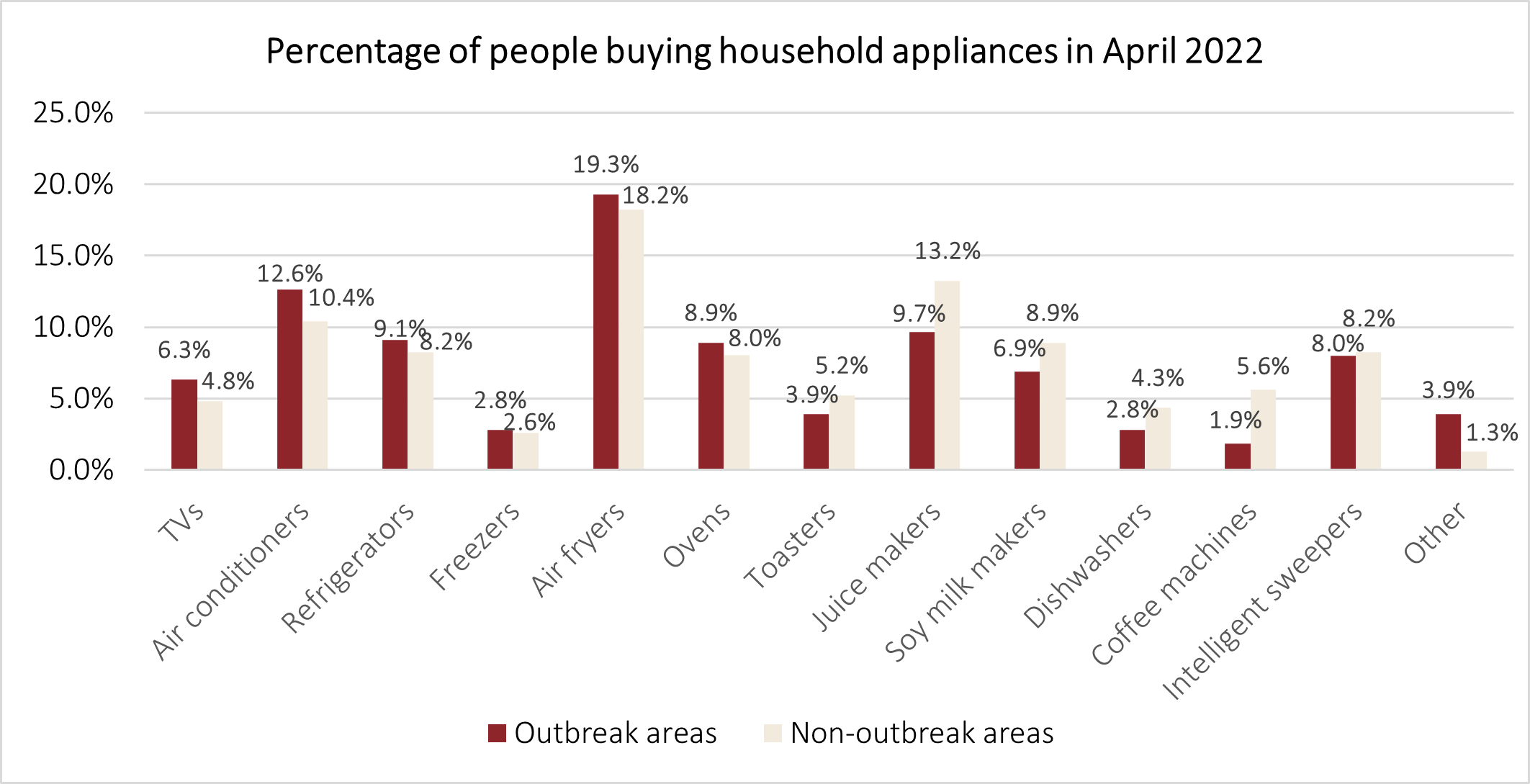

As shown by our survey results, in April 2022, 80% of people spent more on food and beverages. Lockdown led residents to stock up on fresh food to ease anxieties and prepare for uncertainties. In addition to food expenditures, people also spent money on household appliances. Compared to non-outbreak areas, people in lockdown areas spent more on basic household appliances such as air conditioners, refrigerators, freezers, rice cookers, and kettles in April. They also planned to increase this part of their budget in the Q3. Air fryers, which are an incredibly easy way to cook just about anything, were particularly popular among consumers in lockdown areas, with 19.3% of locked down residents buying them in April, significantly higher than in non-outbreak areas.

As a result, quarantine policies boosted the rapid growth of the “stay-at-home economy”. In response to the uncertainty of a recurring pandemic, this new form of economy is likely to continue into the near future.

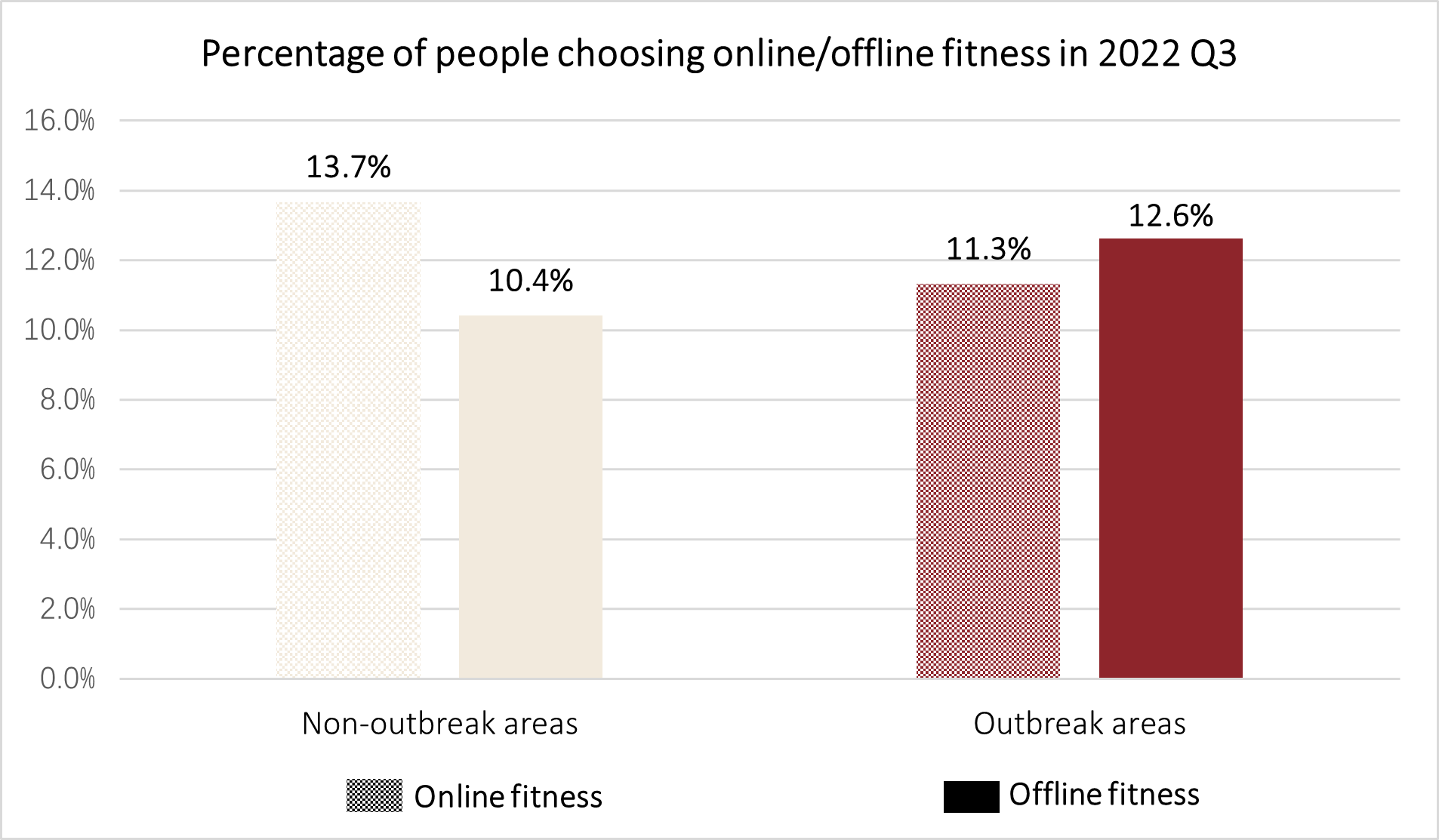

COVID has boosted the wellness economy

Haunted by COVID outbreaks for nearly three years, people are now paying more attention to health and wellbeing. Although traditional off-line gyms were forced to shut down during lockdowns, online workouts became an instant hit when 50-year-old Chinese singer Liu Genghong livestreamed his fitness workouts on social media and inspired millions of people to follow suit. According to our survey, people in non-outbreak areas were more likely to continue following online workouts, while locked down respondents preferred returning to offline gyms after restrictions were lifted.

Aside from personal wellbeing, the recurrence of COVID-19 pandemic has also made people more aware of green consumption. Thus, brands and companies face a daunting task posed by green transformation and China’s “dual carbon” targets.

A survey we conducted at the end of 2021 shows that “reliable in quality” and “a constant and uniform environmental label” are two major factors that increase consumers’ willingness to buy sustainable fashion products. The primary reason that consumers refrain from purchasing sustainable fashion products is a fear of unsafe sources of ingredients. Therefore, to build consumer confidence, brands should strengthen quality control of sustainable fashion products and inform consumers about the source of ingredients.

According to another survey about motivation for purchasing sustainable fashion products in 2021, about 90% of respondents bought such products out of environmental awareness and recognition of sustainability, while about 40% were motivated by the recognition of society and others. Nearly 50% of respondents said they would pay a premium for sustainable fashion products. Among them, about 44% could accept a 10% premium, and about 24% could accept a 25% premium.

These figures indicate that consumers are willing to pay a premium for sustainable products in the pursuit of environmental protection and sustainability, which means brands and companies can be more flexible in terms of the cost of sustainable transformation. Whether consumers make purchase decisions out of a need for personal health management or a desire to protect the environment, brands and products that represent a healthy lifestyle and philosophy will be more likely to be favoured by consumers.

Camping becomes urban dwellers’ new getaway

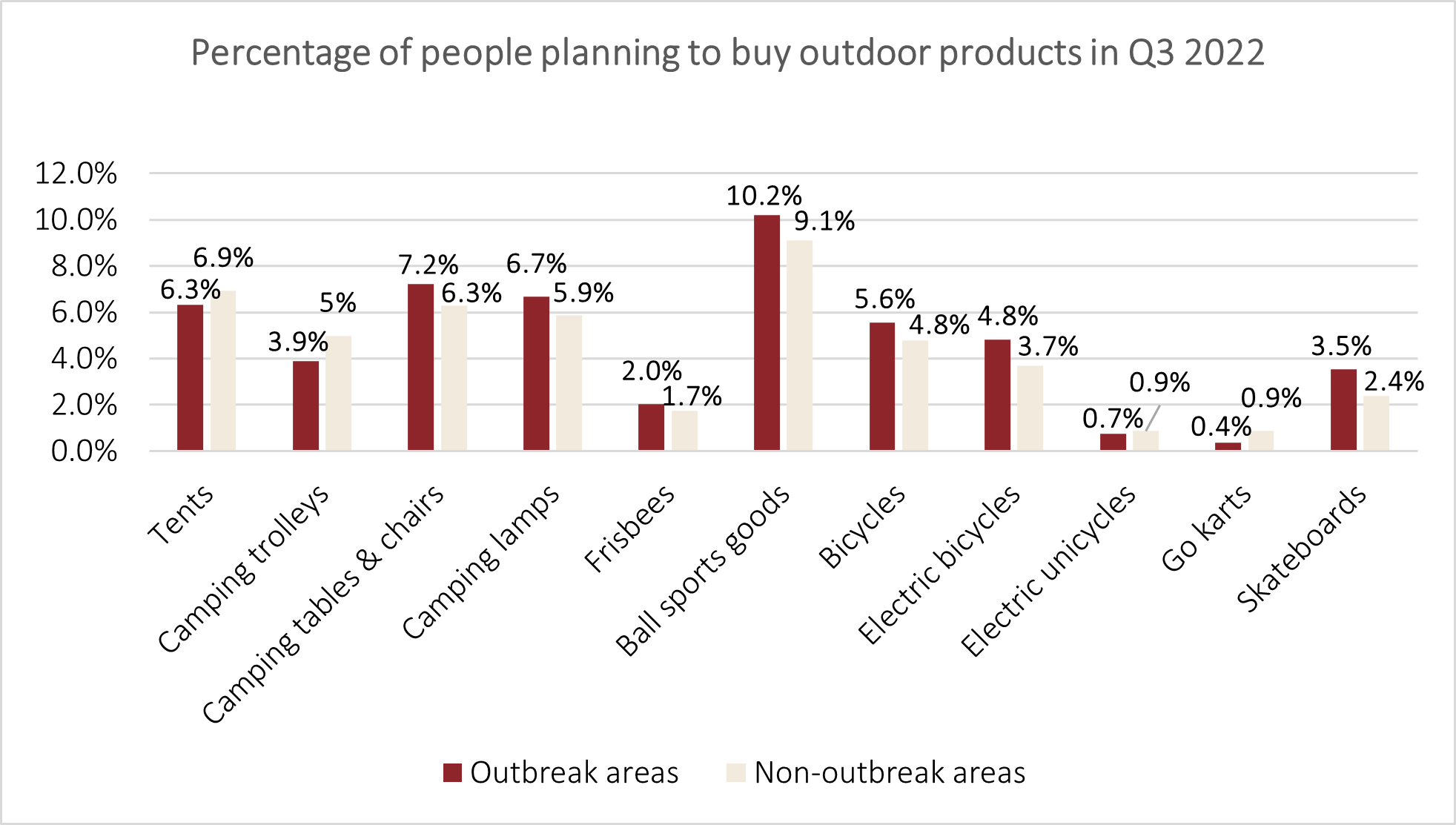

Compared to non-outbreak areas, locked down areas reported more residents planning to purchase outdoor products, including ball sports equipment, camping tables and chairs, outdoor lights, bicycles, electric bikes, and skateboards in Q3. Outdoor activities, especially camping, have become popular getaways for urban dwellers.

The three most popular activities among all respondents were travelling (self-driving, group trips), outdoor sports (surfing, skating, camping), and technology experience activities (AR/VR/MR immersive experiences). Despite several major cities being severely affected by the pandemic in the first half of the year, consumers’ appetites for travel remained strong. If hot destinations can provide convenience for travel crowd while keeping the pandemic under control, tourism could continue to be a major consumption force driving the Chinese economy.

The popularity of camping in China stems from multiple factors:

1. Social environment. As the Chinese government continues to promote environmental protection, there are more places equipped for outdoor activities.

2. Economic growth. China’s rising economy has expanded its middle-class, which now has time and money. The country’s growing car population has also fueled outdoor getaways.

3. Holiday arrangements. The imperfect paid holiday system in China has led to concentrated travel during traditional public holidays when people suffer from poor experience due to overcrowding in trip destinations. This has given rise to weekend getaways in nearby areas.

4. Health and wellbeing awareness. An increasing number of Chinese consumers are becoming keen naturalists and are eager to relax from their stressful daily work which has been exacerbated by prolonged lockdowns.

5. Travel expenditures. The low economic cost of camping is one of the key reasons camping has become more appealing to young people and the middle-class than other outdoor sports.

Camping connects friends with common interests, brings together family members, and offers a new lifestyle for young people and the middle-class.

Apart from outdoor activities, many people seek social connections in the virtual world. Fuelled by the concept of the “metaverse” and increasingly sophisticated technologies in recent years, people’s demand for pan-entertainment industries has also risen to a new level, leading to unprecedented interest and desire to build virtual worlds. Hemmed in by COVID restrictions, many consumers have sought respite from spending money in virtual spaces. Whether it is the immersive experience of virtual games, or purchasing products endorsed by virtual idols, consumers are offered “emotional value” that is difficult to fully satisfy in real-world activities. This is especially true for China’s younger generation, who were born and raised in a world where reality and virtuality co-exist and who show a natural interest in brands with a sense of technology. According to a survey in late-2021, over 70% of young respondents (aged 25-34) said a brand’s self-developed virtual character would possibly make them more willing to buy that brand’s products.

The outbreak of COVID-19 and the rapid iteration of consumption patterns in the Chinese market have provided both new opportunities and challenges for the business world.

Our survey about consumption trends during the past three years reveals that people are becoming more conscious about savings and have gradually decreased their spending. This means that consumers are more focused on products’ cost-performance and practicability when making purchasing decisions, two areas that Chinese brands outperformed in both 2020 and 2021. Therefore, whether it is a national or international brand, improving the value-for-money of products will be essential to attract a wider consumer base.

Life under lockdown has also led people to focus on improving their living conditions at home, giving birth to the “stay-at-home economy”. The pandemic resurgence has further raised people’s awareness of health, motivating them live a healthier and greener lifestyle. After spending extended periods of time at home, consumers have become eager to get out into nature and explore the virtual world to meet their social and emotional needs.

In light of this, companies must contemplate how to better seize opportunities in terms of improving the cost performance, quality and design of products, branding, and optimising marketing strategies. For companies affected by the pandemic, they should consider how to adjust their product structure and seek profit by meeting consumers’ needs for staying at home, health, outdoor activities and social connections.

Never waste a big crisis. Facing the tremendous impact of COVID-19 and economic turbulence, only companies that adapt to change and strive for new opportunities will stand out.

Wang Qi is Professor of Marketing at CEIBS. For more on her teaching and research interests, please visit her faculty profile here.