How to Develop Strategic Agility for Turbulent Times

Prof. Jeff Sampler

Professor of Management Practice in Strategy, CEIBS

Strategic planning is basically a two-step dance. Firstly, you assess the current position – the competitive landscape, the industry status quo, the general environment. Then you get your crystal ball out and try to look into the future – this is the strategy formulation step. But in a rapidly changing world, one with more dramatically divergent outcomes (sometimes ones that were considered unthinkable), the current strategic planning process is broken.

What is the fundamental problem with this simple process? The problem is that it is now extremely difficult to predict the future with any degree of certainty. A few years ago, oil was at $147 USD per barrel. At the time, most analysts predicted that within six months, the price would hit $200 per barrel. In reality, it slumped to $60 per barrel – a previously ‘unthinkable’ reversal. Traditional strategic planning wasn’t helpful even in oil, one of the most well understood industries in the world. Such wildly divergent scenarios are playing out across the world, in practically every major industry.

Asset fungibility: A flexible approach to strategic planning

If the old model is broken, then we need a new one. We need an approach that equips us for as many different eventualities as possible. Ask yourself: What are the elements of a business model that I need no matter what happens in the future?

Imagine you’re going on a world tour. Naturally, you will encounter all manner of climates and scenarios, but you only have a 20kg luggage allowance. What do you take? Ideally, you take things that are flexible, like clothes you can layer, for example, so that you can dress up or down depending on the situation. You wouldn’t take a tuxedo or a ball gown, because they have limited utility and take up too much space in your suitcase.

This, in essence, is asset fungibility – the flexibility of assets. Cash would be the most flexible, or fungible, because it can be exchanged widely for almost any goods or services. Contrastingly, a factory making chemicals is inherently inflexible; you can’t do much else with it, other than convert it or sell it to a specific buyer.

To be flexible in the currently unpredictable age, we need to sit back and decide which assets are fungible and which aren’t. If our assets are fungible, how can we best leverage them to capture value and avoid risk? If they aren’t fungible, then what needs to change – the assets we hold, or the business model we follow? Is a more fundamentally different approach required?

Technology is the main driver of change and disruption in business today

The subtitle above also held true for the past century, and arguably for the majority of human history. Major innovations enabled by new technologies impact management strategy not just in the short term, but for decades to come. Often, even when radical innovations fail to catch on, they’re not wrong – it is just too early.

I’ve been working with professionals at MIT for about 20 years. I go back to visit regularly. The last time I was there, I went to see a show called IT in Fashion. It was all about how technology would integrate into fashion. Imagine applying nanotechnology to a shirt that opens it up and lets it breathe in hot weather, and then closes and provides warmth in cold weather. It sounds incredible in both senses of the word – it’s amazing but also not quite believable.

Unconvinced, but inspired, I looked back in time to find the first example of a wearable technology that was introduced to the public. It was the ‘wearable radio’ of the 1940s. As you might imagine, it was bulky, heavy and nigh-on unwearable, while also ridiculous to look at. It was a frustratingly failed idea. Fast forward 30 years, this exact idea was realised in the form of the Sony Walkman. The idea for highly portable personal music player had been around since the 1940s, but it took three decades for the technology to develop it into a viable reality.

So, if you want to understand the future of technology, look to the past. World-changing technologies may be introduced too soon, or at the wrong price point, or they may be marketed badly, but eventuality they are proven to be right. This is a major problem that tech innovators face today. They come in wearing the ‘portable radio’ equivalent for their target industry and tell everyone that if you don’t adopt their technology early on, you’re dead.

The simple reality is that there are two ways to go bankrupt when it comes to technology – first, buy everything, and second, buy nothing. Buying everything means you spend too much, with too little time to implement. Buy nothing means that you are doomed to be destroyed by competitors who do innovate.

The key is to decide which technologies are right for your company. Which ones are best suited for your operations and customers? Selective adaptation, not blind adaptation, is what is required.

Technology’s evolving impact on business – A three-stage journey

Put simply, technology allows us to do new things. It opens up new business options. As managers, we must decide how technology will change our business. If you’re not adapting your company at the rate of technological innovation occurring in the world today, you are falling behind. Accordingly, you must ask yourself: Is your business changing as fast as the world is? If not, how long can it last?

To understand the true impact of technology on business, specifically on management strategy, we can break it down into roughly three levels:

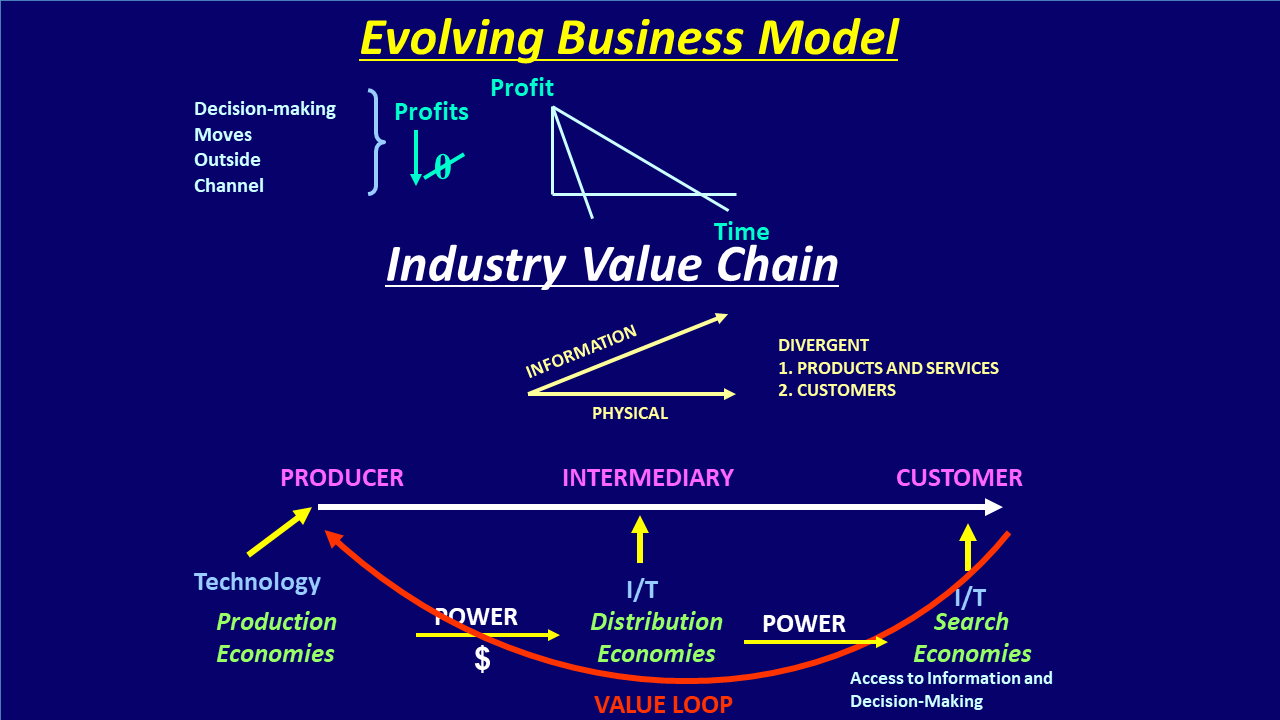

Production level – The Industrial Revolution (1760s-1840s): Dramatic technological advancements enabled the “production economy” where, human labour suddenly became scalable. Businesses could achieve massively higher output with the same number of workers. Prices remained constant while marginal costs went down dramatically, causing an explosion of profit and wealth.

Intermediary level – IT Networking Revolution (1970s-1980s): Computing power and business software enabled the “distribution economy” where retail was completely overhauled. Big stores became possible as barcodes and scanners revolutionised inventory management, leading to 20 years of management innovation and the creation of just-in-time delivery, supply chain optimisation and other hallmarks of modern-day logistics.

Customer level – Digital/Internet Revolution (2000s-2020s): The advent and explosive development of the internet, along with the rising ubiquity of smartphones and personal computers, has finally enabled today’s “search economy” where data is both scalable and an invaluable resource. Innovation can now occur at any point in the value chain, and the pace of adoption is accelerating exponentially.

What does this three-level impact of technology tell us? Essentially, throughout history, technology has provided businesses with four types of benefits. With the intelligent implementation of a given technology, you can:

1: Do things faster

2: Do things cheaper

3: Do things with greater reliability

4: Do more complex, ambitious or innovative things successfully

If we return to the example of barcodes and scanners, this single technology offers all four benefits listed above. Before the realisation of IT, retailers understood how having big stores would benefit them, but the complexity and risks associated with the task were too great. This revolutionary technology greatly reduced the associated risks, allowing for faster, cheaper and more reliable management of highly complex inventories.

With this new status quo, retailers are scrambling to create the best IT setup, outperform their competitors and benefit from the emerging technology. Essentially, technology removed the risk and complexity, allowing its adopters to create scale. Whoever managed this most successfully would become the industry leader. In the case of retail, this race was won by Walmart.

Walmart – An exemplar of strategic agility… to a point

In its heyday, Walmart (an IT company disguised as a retail company) optimised the interface between manufacturers and distributors to such an extent that they could see exactly what was happening in terms of sales in their stores nationwide in real time. For the time, this was unprecedented, and it secured Walmart vast competitive advantage.

In the wake of the 9/11 terrorist attacks, the US expressed its grief with patriotism. One symptom of this was a national explosion of buying American flags. With its state-of-the-art IT setup and strategically agile mindset, Walmart spotted this trend within 15 minutes. On September 11, they ordered as many US flags as possible from their partners. On the next day, they sold 120,000 of them.

Walmart did something that should have been impossible; they achieved scale and agility at the same time. They combined these elements in a way that made them simply unbeatable for decades. Their dominance has only recently been disrupted by the sea-change of digital innovation. Today, Walmart is finally being challenged by the likes of Alibaba and other ‘data-first’ companies who are taking the mentality and capability pioneered by Walmart to the next level.

The decades-long dominance of Walmart demonstrates the power of combining scale and agility through the intelligent use of technology. Their waning influence is a warning that scale and current capabilities do not guarantee continued success in the digital age.

Today, it is essential to control the ‘decision-making space’

The ubiquitous nature of technology means that today, innovation is frequently happening outside the traditional places (i.e., government agencies and big companies). Startups and individuals can create the next big thing and the lightning-fast pace of adoption means that big firms can be neatly sidestepped overnight, losing out to the nimble newcomers.

Therefore, all companies must be willing to look for new sources of value in unfamiliar places, specifically technologies that are the right fit, at the right time, to achieve the right capability.

This mentality of strategic flexibility goes beyond seeking out specific technologies. Previously, the physical and information worlds were one and the same. You could only get information about a given product in its physical store, with limited information available elsewhere. But with the internet, search engines, livestreaming and social media, these two worlds have now separated.

Accordingly, the biggest winners in the digital age are those who have adopted the mindset of trying to control the decision-making space above all else. They control the decision-making process; hence they control the vast majority of the profit-making potential of the business transaction. In the age of search economy, most consumers have done their own online research and made their own purchasing decisions long before they step inside a physical store, if they do so at all. Across the world, this shift in consumer behaviour is killing traditional businesses (especially those with large physical infrastructure setups) left, right and centre. This has led to the creation of a fundamental business principle:

As decision making moves outside an existing channel, profits within that channel will go to near-zero. Profits now migrate to where decisions occur. Whoever controls the point of decision making will capture the value.

Take the example of Uber or Didi. Their business model is essentially saying to their drivers: “You own the car. You drive the car. You take the risks. However, we control the decision-making process, so we make most of the money.”

It’s exactly the same with AirBnB and their network of short-term letters: “You own the property. You host the customers. You take the risks. However, we control the decision-making process, so we make most of the money.”

Both are perfect examples of how technology has enabled a highly complex business model, simplifying it and reducing the risk while creating scale. Increasingly, the scalable, data-driven business that controls its consumers’ decision-making space is becoming the hallmark of a digital age winner.

For true strategic flexibility, you must become a ‘data-first’ organisation

Being strategically flexible today means being able to look at all your data in a unified way, and then going where it leads you. In previous ages, businesses organised around resources (gold, oil, wool, crops, etc). Then they organised around the production assets (factories, workshops, etc). Today, we must organise around the data.

Companies like Google, Apple or Alibaba have never tried to shape the data to fit their current organisational model. Instead, they unfailingly follow the data; they adapt to what the data tells them. They keep their data as a unified resource, turning it into a single data ocean which is interconnected and capable of revealing the most important strategic insights.

The long march of technological innovation to our current point in history is the story of making things scalable. While the industrial revolution enabled the scalability of human labour, the digital revolution is powering the scalability of data.

What you have to decide is: Which scalable benefit will be essential in keeping you agile, and hence effective, in the future? For some companies, their target for scalability will be in manufacturing, others in distribution, and still others in search economies. However, in all cases, pinpointing the answer will require a data-first perspective.

Therefore, to be strategically flexible, you cannot rely on a business framework based on familiarity. If you harness and follow your data, you can understand and react to changing environment faster than your competitors. The faster and more frequently you do that, the more likely you are to create a competitive vortex, where the value loop keeps producing competitive advantage quicker and quicker.

This is where the truly great business innovators of today exist, within the vortex. Here, you’ll find the heart of strategic advantage in the digital age. But to get there, it is essential to have a data-first, and digital-driven perspective. This is what we can see happening in China perhaps more strongly and frequently than anywhere else in the world. The GEMBA programme is an opportunity to witness this first-hand, and essentially see the future of business strategy.