A Taxing Problem

New research shows that MNCs pay a price when keeping cash abroad

Most multinational companies park their foreign earnings in jurisdictions with favourable tax policies in order to reduce their tax bill. A recent European Commission investigation into Apple’s tax strategy has brought wide attention to the issue. The Commission ordered the company to pay nearly $14 billion in back taxes plus interest to Ireland, and accused the Irish government of providing illegal state aid to the iPhone maker by allowing it to shelter its money from tax collectors there. Both Apple and the Irish government are disputing the ruling.

While these tax strategies for foreign earnings are meant to deliver a savings to shareholders, the results of a research study co-authored by CEIBS Professor of Finance Wang Cong show that keeping large amounts of cash stashed abroad may actually depress a company’s share price, because investors discount the value of foreign cash reserves. In addition, the results show that their home country not only misses out on tax revenues, it also loses a potential engine for creating jobs and economic growth because companies tend to deploy their foreign cash holdings for investments abroad.

In the study, Prof. Wang and his co-authors, Prof. Jarrad Harford of University of Washington and Kuo Zhang of Xiamen University, looked at a sample of US-listed multinational firms that disclose their foreign cash holdings. The findings show that the more cash a firm holds overseas, the lower shareholders value that cash. The researchers also found that firms with large cash holdings overseas tend to underinvest domestically and overinvest abroad. In addition, their findings showed that during 2005 and 2006, many US multinationals took advantage of a one-time tax holiday created by the American Jobs Creation Act and repatriated a significant amount of their foreign cash holdings, and the market responded favourably to those companies. The researchers found there are three main reasons why investors discount multinationals’ foreign cash holdings: the looming tax penalties for repatriation; liquidity issues – firms may borrow money for domestic investment rather than repatriate foreign earnings; and potential agency problems if funds are held in countries with poor governance and transparency.

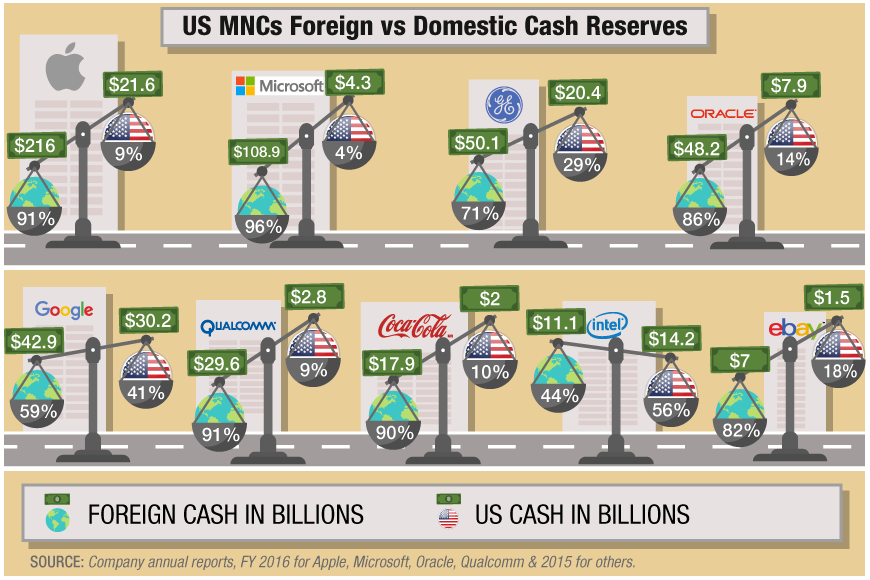

According to Apple’s annual report, during its 2016 fiscal year, the company held 91% of its US$237.58 billion cash reserves abroad. The chart above shows the disparity in the foreign and domestic cash holdings of several other large US-based multinationals.

The findings appear in the paper titled “Foreign Cash: Taxes, Internal Capital Markets, and Agency Problems” which will be published by the Review of Financial Studies. Read the paper here.