China & Russia Lead 2017 Emerging Market Soft Power Index

How does the soft power of emerging markets compare to that of more developed economies? Is there a correlation between soft power and GDP? What does the number of Olympic medals a country wins have to do with its global influence? Director of the CEIBS Center for Emerging Market Studies, Parkland Chair Professor in Strategy Seung Ho (Sam) Park, explores these questions and more in the 2017 Emerging Market Soft Power Index.

Among the findings: media exports, immigration and secondary education are some of the more important variables that have a strong influence on a country’s soft power ranking. In today’s information age, media exports (i.e. films, television shows, pop music, news channels) help a country spread its culture beyond its borders, and are an indicator of how popular a country is abroad. Immigration reflects the amount of personal exchange between a country and the rest of the world and it follows that a country that attracts more immigrants has more soft power. The more admired a country is, the more others want to emulate it and this can guide other countries’ behaviours – thus the more admired a country is the more soft power it has.

Other findings:

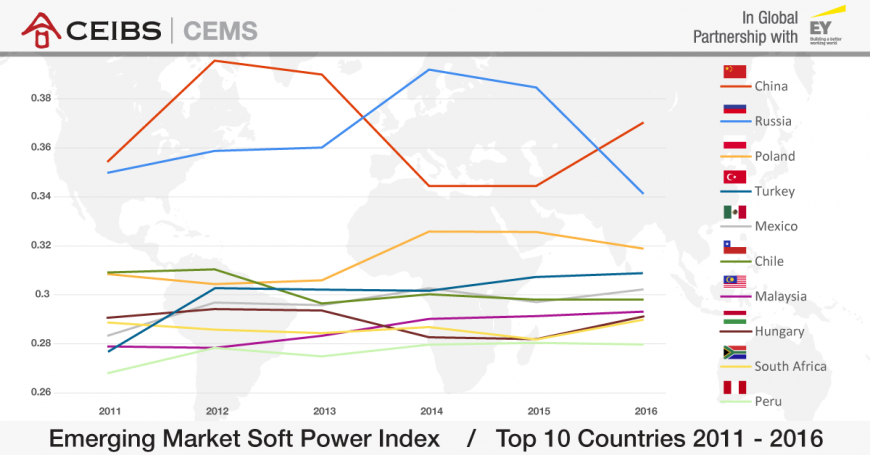

- China tops the soft power ranking among emerging markets, and it now has more soft power than two G7 countries, Japan and Italy.

- Russia has risen from third to second place since the previous Index, which was released in 2012.

- The top 10 emerging market countries’ soft power scores are much closer to each other now than they were previously.

- For countries in Latin America and Eastern Europe that were among the Index’s top 10, national language enrolments abroad and secondary education levels contributed to boosting their position on the 2017 Index. Spanish is the national language for the majority of countries in Latin America and it is also the second language for the US, behind English. In Eastern Europe, Russia’s soft power is enhanced by the large number of students in other Eastern European countries who study Russian.

The report ranks the soft power of 113 emerging markets which, in recent years, have taken on larger roles in the global economy. The goal is to better understand how much soft power these countries have, relative to one another, and how their soft power compares to that of more developed countries, specifically the G7 countries – Canada, France, Germany, Italy, Japan, the UK and the US.

There is a close correlation between soft power and a country’s level of economic development because countries with higher levels of GDP per capita tend to have features that boost their soft power, for example they are more likely to attract immigration and export media products. Even the number of Olympic medals earned tracks closely with GDP per capita. As he notes in the report, Prof. Park expects that China will continue to gain ground in soft power in the coming five years, particularly because its GDP growth rate far exceeds that of the US and the other G7 countries. China’s Belt and Road Initiative and embrace of multilateralism are prime examples of a rising superpower using soft power to align other countries’ interests with its own, he says. By contrast, the reputation of the US has been impacted by its announced withdrawal from the Paris Climate Accord. In light of this and recent political developments in the US, Professor Park notes that emerging markets now have more room to increase their role in the global community.