Navigating the China market: 8 trends from our 2023 CMO report

By Wang Gao

Buzzwords like “industrial transformation” and “new cycle” are gaining prominence in the local business vernacular. In this fresh phase of growth, how businesses can navigate these fundamental shifts and challenges within the current marketing climate has emerged as a topic of shared concern.

In 2023, a wave of transformation swept across numerous industries in China, necessitating significant changes in thinking, brand image, and marketing tactics. Whether it was a global wave of change or shifts in how companies innovate and market, a “new quality marketing force” has emerged. Centred on new products, new brands, and innovative marketing strategies, this force has become the key driver of what we refer to as “new quality productivity.”

As China’s manufacturing capabilities continue to rise, there has been a significant shift in consumer needs. However, the response from the supply side has been slow to catch up. Businesses are still primarily focused on providing an array of quality goods to Chinese consumers, leading to a high supply and production capacity. Yet, the rate of consumer demand is slowing down, and purchase decisions have become more cautious. This has resulted in a pronounced excess of supply relative to demand.

Many products are stuck in a cycle of homogeneity, competing on the same playing field. When we talk about “new quality productivity” and “new quality marketing”, we must remember that marketing should be solid, responsible, and effective. Every dollar and resource invested should deliver results for the company, create a competitive edge, and serve consumers. This is the way to ensure healthier business practices and a more balanced industry ecosystem.

New avenues for growth often emerge from shifts in trends like these, but identifying new drivers of growth requires foresight into future trends. The 2023 CMO Survey Report in China offers us a glimpse into these pivotal shifts.

Report Summary

The 2023 CMO Survey Report in China was conducted from April 23, 2024, to May 17, 2024. The core of the survey were members of the CEIBS Alumni CMO Club, encompassing a broad range of mainstream Chinese brands and companies across over twenty industries. These include four major business categories: B2B products, B2B services, B2C products, and B2C services, and span all scales of businesses from small and micro enterprises to large corporations. The report zeroes in on eight key trends in innovative and high-quality marketing in China, providing crucial insights for enterprises to sketch a clear roadmap for future development in the country.

In times of macroeconomic instability, marketing decision-makers remain resolute

A wave of pessimism has washed over China’s macroeconomic climate in the past years, with optimism dipping from 52% in 2022 to a mere 22% in 2023. Pessimism has also climbed from 15% in 2022 to 35% in 2023. Despite this, any Chinese entrepreneurs are standing firm with 60% remaining optimistic about the growth of their businesses in the coming year.

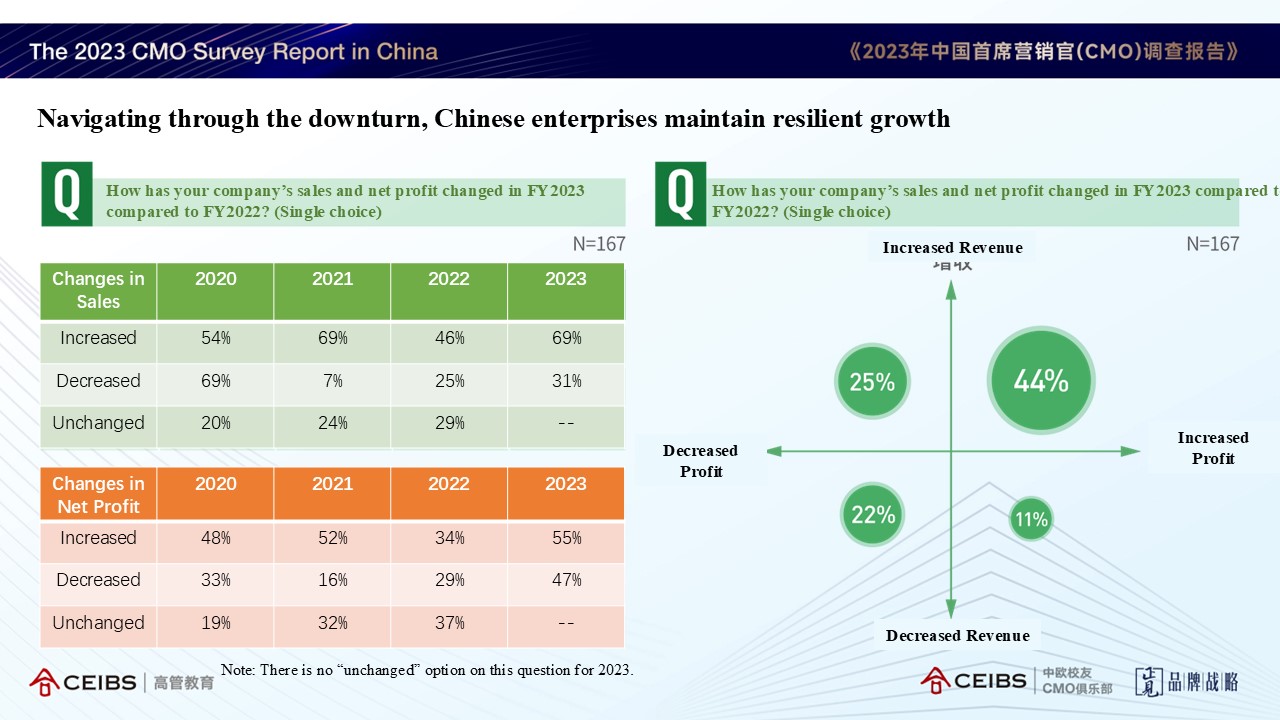

In these challenging times, Chinese companies are proving surprisingly resilient. In 2023, 69% of these companies managed to sustain growth in sales revenue and 55% sustained growth in net profits, with 44% maintaining growth in both.

Facing fierce competition, companies expand for sustainable growth

China’s marketing environment is becoming increasingly competitive. This makes innovation the key to achieving sustainable high-quality growth.

In 2023, companies that recorded a rise in both revenue and profit largely attributed their success to industry growth, their own competitive strengths, and strategies focused on boosting growth incrementally. Conversely, companies that saw a surge in revenue but a drop in profit primarily saw this as due to feeling a need to slash prices and run promotions to stay competitive.

In such a hyper-competitive marketing environment, companies that excel at cost control can reduce their revenue while still increasing profits. However, when industry conditions worsen and market saturation leads to intensified competition and inflated costs, companies may experience a decrease in both revenue and profit.

To combat this, many companies are turning to expansion strategies to achieve growth. In fact, 29% of companies surveyed have reduced their investment in the Existing Market and Existing Products/Services category in favour of pursuing new market opportunities.

Phased compression of marketing costs in 2023: Companies gear up to break the cycle in 2024

As pressure for growth mounts, marketing budgets have been squeezed, with their share of revenue dropping to 17%.

To adjust to this environment, companies are shifting their marketing cost allocation priorities. While R&D costs for products and services are increasing, traditional media has become a lower priority for investment, with 58% of responding companies choosing not to invest in this sector. Instead, efforts are focused on public relations, advertising, and labour expenses.

Looking forward to 2024, companies will likely strengthen their marketing investment to cope with increasingly fierce competition and achieve sustainable growth. In terms of resource allocation, companies will focus on products, brand building, cost reduction, and increasing efficiency, in order to build multi-dimensional competitiveness.

WeChat, Douyin, and Xiaohongshu: Solidifying their roles as the main platforms for digital marketing

In 2023, digital marketing saw a reduction in its average budget allocation, decreasing from 33% of total marketing expenses in 2022 to 28%. The amount outsourced to third parties also saw a notable drop, decreasing from 32% in 2022 to 17% in 2023.

WeChat, Douyin, and Xiaohongshu rank as the top three platforms for digital marketing due to their high user engagement and investment levels.

Live streaming marketing has, meanwhile, experienced a decline, with a decrease in its reach and overall resource allocation. Businesses are now regularly streaming their own content, primarily on Douyin and Taobao, with video platforms serving as additional outlets.

AI and ESG: emerging marketing modalities in China

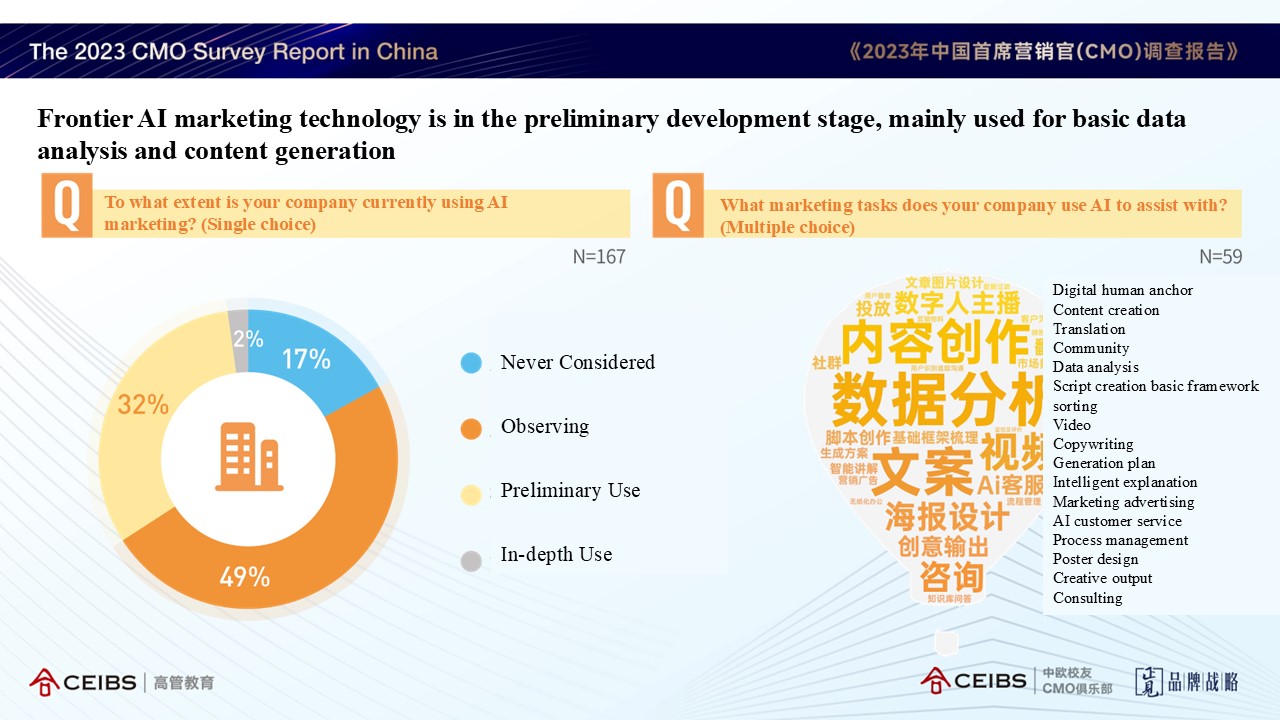

The adoption rate of AI in marketing remains low, with only 34% of companies currently utilising AI marketing tools. The main forms of AI marketing currently in use are related to data analysis and content marketing.

Chinese companies are, meanwhile, integrating ESG into their marketing, primarily through public welfare marketing. While the concept of ESG is widely recognised and rapidly developing, however, execution remains difficult, with only 23% of companies attempting to deeply integrate ESG into their marketing activities. As corporate scale expands and stakeholders become more influential, and with the impact of listing policies, the role of ESG will likely grow.

Marketing shift: Back to basics while strengthening brand investments

Marketing in China is returning to the fundamental functions of its role, moving away from a focus on growth to emphasise brand building.

The most widely set basic functions of marketing departments surveyed include market research, communication and promotion, user research, and content marketing. B2C companies assign a wider range of functions, with significant differences in areas such as new media operations, media placement, brand experience management, and live e-commerce operations. Learning ability, communication ability, and execution ability are the main requirements for those selecting future marketing talents.

Brand investment continues to grow, with 68% of surveyed companies setting up brand management functions. Over the next three years, 90% of companies surveyed plan to maintain or strengthen their brand building efforts. Improving brand recognition, conversion rates, and attractiveness are the top three measures of effectiveness, with only 5% of companies believing that their brand building efforts have had no discernible impact.

Going global: A key growth engine for Chinese enterprises, with a consistent shift towards high-value sectors

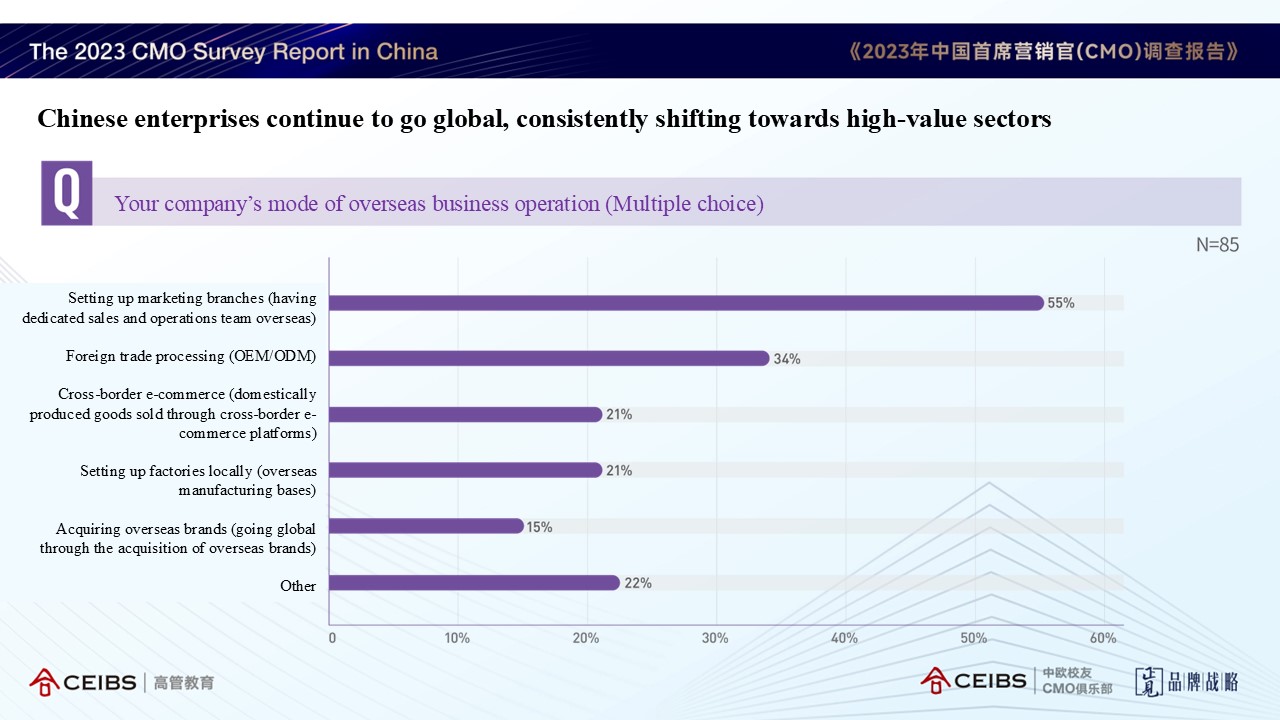

The benefits of overseas expansion, also known as chuhai, has become a consensus among an increasing number of Chinese companies. Over half of surveyed companies have already established a presence overseas, while a mere 20% have yet to consider international expansion. The main reasons for entering overseas markets are to explore new markets and to boost revenue for greater profitability. Most respondents note stable contributions from overseas operations, with the electronics and electrical industries leading the charge in global outreach.

The trend of Chinese companies going global continues to establish itself further and is no longer confined simply to traditional outsourcing. Over 50% of companies surveyed have set up overseas marketing branches, more than 20% have established factories abroad, and approximately 15% have acquired foreign brands.

Overseas support for Chinese companies going global grows, but compliance remains still a long-term proposition

The international network of Chinese corporations continues to grow, with ASEAN, Europe, and North America serving as the primary overseas markets.

The main challenges facing these cross-border pioneers comes not from competition from overseas counterparts, but from basic factors such as talent, culture, and compliance. This reflects not only the complexity of the current international trade environment, but also the stage of early development that Chinese companies going global find themselves in.

How should companies react to these trends?

New quality marketing

To succeed in today’s Chinese market, companies must adopt a sustainable, win-win marketing strategy focused on expanding industry success, as opposed to a mutually destructive, combative approach aimed at beating competitors. This win-win philosophy in fact extends beyond just competitors, encompassing consumers and society at large.

Avoid competing on price alone

In a market where supply outweighs demand and competition is homogenized, price can seem to be the only way to gain a quick advantage. But if every company competes on channels, traffic, and promotion, enterprises will soon find themselves in a no-win scenario in which much is spent but demand doesn’t increase, leaving no victors. Overall, the harm caused by such “involution” is not only felt by competitors: if businesses cannot gain a fair return from their operations, they will in turn lack the motivation to invest more resources into improving their products and services. Ultimately, the real victims w be consumers and the whole society.

The issue of “involution” parallels the prisoner’s dilemma, in which everyone could potentially be a victim or an offender. Therefore, it is crucial for companies to examine whether they are unintentionally bringing this scenario about.

Businesses should refocus their competitive energies on products, seeking market dominance through continual product improvement. High-quality products are desired by consumers not just in China, but globally. It is vital to have a level-headed approach to marketing costs, using marketing as a supporting tool to add value to top-tier products. When products lack uniqueness and innovation, marketing alone cannot bring about positive outcomes. Relying on short-term sales tactics based on low prices and subsidies will not cut it in the long run. Sustaining a business over time might call for some compromises, sometimes sacrificing immediate profits to avoid a short-term, quick-profit mentality.

The interplay between domestic and global markets

Businesses should cultivate a global perspective, giving priority to target markets that align best with their core competencies. only if extra resources are available should expansion into less certain markets be pursued. From this perspective, having a foothold in the Chinese market can also be considered a global strategy. Chinese companies venturing abroad, must commit to long-term operations, gain a deep understanding of local market demands, and cater to them with top-tier products. Merely taking Chinese products and selling them overseas is not a sustainable strategy for the future.

About the 2023 CMO Survey Report in China

The 2023 CMO Survey Report in China is a collaborative effort between the Executive Education Programme of the China Europe International Business School, the CEIBS CMO Club, and Brandv. The purpose of the report is to monitor and reflect the marketing landscape in the Chinese market while anticipating future trends. The 2023 annual report has been subject some revisions, with the addition of modules like AI marketing and brand management, an amplified focus on business global expansion, and an optimisation of certain module structures. As a credible research output targeting China’s CMO community, the report offers a thorough and authentic reflection of the present scenario and momentum of marketing within Chinese enterprises.

WANG Gao is Professor of Marketing, Baosteel Chair in Marketing, Associate Dean and Director of Executive Education Programme, and Director of the Chief Marketing Officer (CMO) Programme at CEIBS. For more on his teaching and research interests, please visit his faculty profile here.