Is ESG a blessing or a curse?

By Su Xijia

ESG – environment, social, governance – is undeniably one of the most popular managerial paradigms today. It is not, however, just an empty slogan, but a profound change in corporate business philosophy and business behaviour. That said, it also involves incurring a high cost, thus proving both a blessing and a curse. How should companies leverage ESG’s benefits and risks?

In recent years, the pursuit of ESG has become a worldwide corporate megatrend. For a long time, companies have pursued economic benefits and scalable growth while neglecting environmental protection and stakeholder benefits. The concept of ESG emerged as a reflection of these biased behaviours, urging companies to act with conscience and responsibility.

ESG is not an empty slogan, but a profound change in corporate business philosophy and business behaviour. Many companies now disclose their ESG information, ratings and investment. This means ESG has evolved into a standard and guidance for investment and existing companies’ financial costs. It is predicted that, in the future, a company failing to meet ESG standards will have to accept great burdens to achieve financing. Listed companies face tighter restrictions on ESG disclosure and compliance, and those that fail to meet requirements may be subject to regulatory penalties.

However, a correction that goes too far can lead to overkill. Will ESG requirements be overstretched and hinder companies’ healthy operations? This is a topic we need to explore further.

Let’s start by asking two questions:

First, imagine that you are going to buy a cup of coffee. Two cups of coffee are available, one priced at 15 RMB, and the other at 20 RMB. They taste no different and are of the same quality. The only difference is that the higher-priced cup comes from a company rated at ESG-AAA, and the other doesn’t have an ESG rating. Which one would you buy?

Second, suppose you go to another cafe, and two cups of coffee at the same price are available. One has your preferred taste and quality, but from an ESG-unqualified supplier. You don’t like the taste of the other one, but it is produced by an ESG-AAA supplier. Which one would you buy?

The first question indicates that ESG is associated with a cost, usually a high one. But who will pay for this cost? Apparently, end users. The end users have no choice but to spend the extra money. Therefore, if all companies get an ESG-AAA rating, their production costs will surge. They will then raise their prices to offset these costs. When end customers see no income increase but have to bear greater expenses, they buy less to maintain an unchanged personal balance sheet. People with the most basic spending power will have difficulties making ends meet. This is by no means the desired result of ESG advocates. In other words, the high costs of ESG will lead to an increase in ‘quality’ at the sacrifice of ‘quantity.’ Of course, this benefits some groups, but it also hampers many others.

Even if costs are transferred to customers, the journey to ESG is not plain sailing for producers either. I once visited an oil pipeline manufacturer. It was a large energy consumer and carbon emitter which produced substantial waste gas and water. The company’s profitability was too humble to support any major transformation. Therefore, from a shareholder perspective, facing such challenges, it could have been better to just shut the company down. But they did not. There were thousands of employees working at the company with families to support. Thus, although struggling, the company continued to operate under pressure from increasingly high ESG requirements and operational costs.

In fact, this challenge torments many low-end manufacturers. Although many Chinese manufacturers wish to move into high-end manufacturing in the future, it is easier said than done. The reality is that most manufacturers will struggle with upgrading and transformation.

I personally believe that adhering to ESG is an inevitable choice as society and the business world evolve, but it is by no means a one-size-fits-all solution. To some extent, ESG is a game for rich players. Companies with advanced equipment, cutting-edge products, robust profitability, and strong price negotiation power are more likely to become the winners in this game. However, for SMEs struggling for survival, joining the battlefield of ESG might be the proverbial last straw that breaks the camel’s back. Therefore, advocates should be more prudent when promoting ESG measures.

Let’s move to the second question. We all know that the underlying logic of running a company is to produce good products and services and deliver solid performance. A company cannot win in the market solely by advocating empty sentiments and concepts. Therefore, what is the value of ESG if it cannot make products better or meet consumers’ needs? Current ESG standards point to how to operate a company rather than how to improve products. The result is that a company producing poor products may still get an ESG AAA rating. Therefore, ESG is not a guarantee for high-quality products.

I’m not saying products are the only priority. Comprehensive development is essential. If a company violates the law or deviates from basic ethical principles, it has to bear severe consequences. A company with poor ESG may also face expensive financing costs or even difficulties with market entry. However, an outstanding ESG rating will not secure a competitive market position if combined with the poor product quality or low operations efficiency. There is no linear relationship between ESG and business performance. This is what corporate management should be aware of when advocating ESG compliance.

It is not easy to review a company’s ESG practices. ESG rating standards are divergent and chaotic, especially on social and governance aspects. There are over 600 ESG rating institutions providing complicated rating standards and methods worldwide, including MSCI, Sustainalytics , FTSE Russell, Sino-Securities Index, and China Securities Index to name just a few. A company may receive quite different ratings from different indices, which is very confusing.

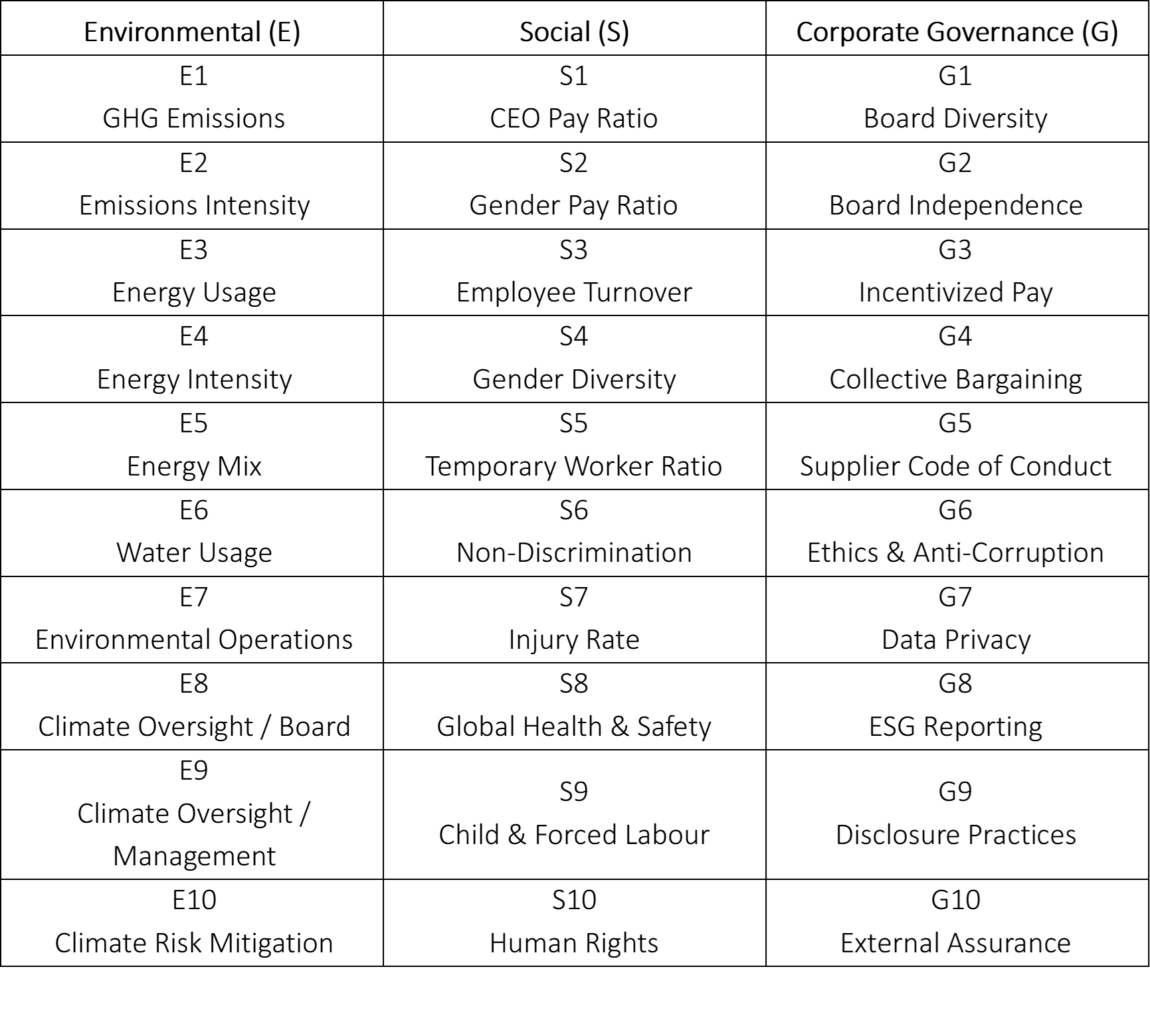

Companies practice ESG according to rating institutions’ scoring indicators and regulatory institutions’ disclosure requirements. Although diversified, indicators used by different institutions are fairly close. Below we may see a concise but typical version.

NASDAQ ESG Reporting Guide

We need to pay attention to several items in the above table. First, nearly half of the indicators (including Human Rights, Ethics & Anti-Corruption, and Environmental Operations) cannot be measured quantitatively. Qualitative review cannot be free from subjective judgments, which implies potential discontent and controversy surrounding results. Second, several indicators (including Board Independence, Temporary Worker Ratio, and Non-Discrimination) are prone to manipulation, making biased reviews possible. For example, a position defined as temporary in a company may be regarded as permanent in another. Injury rate is also difficult to calculate as there are many criteria to determine whether it is a slight or major injury. Some institutions also disagree on whether a company should be responsible for an employee injured during commuting. In addition, most people emphasise environmental indicators because such indicators can be measured by well-developed and accurate standards. However, this leads to another pitfall: people can only see the environmental metrics and inevitably ignore the qualitative reviews in social and governance categories. Such results are biased in nature.

ESG advocacy started in developed countries and matured in emerging markets, with multinationals and established corporations being the first to respond. Such businesses typically have stricter codes of conduct and ethical principles. Society and the public expect them to shoulder more responsibility in leading social development. However, this is not entirely a burden for them. Big companies are very likely to consolidate their competitiveness by implementing ESG measures. After all, compared to SMEs, they have an unparalleled advantage in terms of both power and resources.

To conclude, companies should neither delude themselves into wishful thinking, nor jump the gun when introducing ESG measures. ESG reviewers should also differentiate their standards to facilitate different market entities. For example, ESG reviews could be stricter in giant companies than in SMEs. As I have said above, during a downward economy, overstretched ESG terms will kill already struggling small businesses.

Undoubtedly, China should encourage companies to take on ESG measures, or Chinese companies will be phased out by global competitors. However, we have to be cautious and go step by step. For example, in the early stages, we can propose easily approachable ESG tasks for companies; we may also first choose ESG pilot companies and then broaden the concept industry-wide. High-cost projects should be followed with supportive measures to relieve economic pressure. If we rush into an ESG mania in an overly aggressive way, we will see corporate misconduct, be it false information disclosure or public opinion manipulation.

Let’s return to the two questions I asked earlier. Between the two cups of coffee, I personally believe that most people will choose the cheaper or more palatable one. No one will object to ethical pursuits represented by ESG, but when it comes to making a real effort to meet those criteria, I do not believe people can sustain their claimed passion. The implementation of ESG will not be plain sailing or something achievable overnight. We must be prepared for a long and daunting journey.

Su Xijia is a Professor Emeritus at CEIBS. For more on his teaching and research interests, please visit his faculty profile here.