If your company disappeared, would it affect your industry?

By Vivian Guo

How would your industry be affected if your company suddenly disappeared? It’s a simple question, but one that should make companies reflect on the core of their competitiveness. The second profit curve for enterprises today rests on the transition from product-oriented to service-based offerings. How can such a transition be achieved? Three models may help companies regain their lost advantages: products as services, products + services, and products + solutions.

Competitive advantages in a cup of coffee

If you have ever participated in a strategic management course, you will have noticed that the phrase “competitive advantage” is repeatedly mentioned. What exactly is a company’s competitive advantage? And how can it be built? It is often said that companies exist to create value for customers, but how is value created?

A company’s competitiveness lies in the additional value it creates for the industry in which it operates. What is additional value? If a company no longer participates in the value creation of an industry, how will the industry be affected? The additional value of a company, or its competitive advantage, is the difference between the total value created by an industry with the company and the total value created without the company.

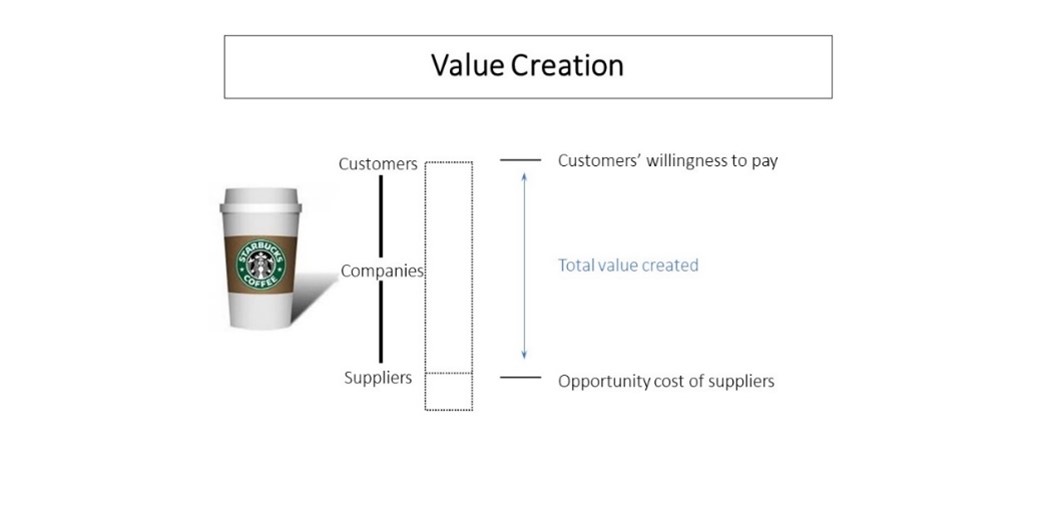

From another perspective, a company’s competitive advantage is reflected in the difference between customers’ willingness to pay and suppliers’ opportunity costs. It should be noted that customers’ willingness to pay is the maximum price customers are willing to pay for a product or service based on their own needs and intentions (instead of the actual selling price). Take a cup of coffee as an example. Customers would be willing to buy it as long as it is priced lower than their willingness to pay. The opportunity cost of suppliers, on the other hand, refers to the lowest price a supplier will accept to provide other businesses with the resources needed to produce the product (service). A company can only secure these resources at a price higher than the opportunity cost of its suppliers.

Even within the same industry, the total value created by different companies varies enormously. This is because customers may be willing to pay different prices for products from different companies. On the other hand, differences in raw materials, basic production factors, and production processes adopted by companies can also lead to different opportunity costs for suppliers. To generate greater value, companies should first and foremost increase their customers’ willingness to pay, while minimizing the opportunity costs of their suppliers. The latter could be realised in two ways: by looking at different suppliers and raw materials and pursuing the one with minimum supplier opportunity costs, or by optimizing operational efficiency to lower the cost and generate greater value. One important way for companies to increase customers’ willingness to pay is to transition from product orientation to service orientation.

Three ways to move from product orientation to service orientation

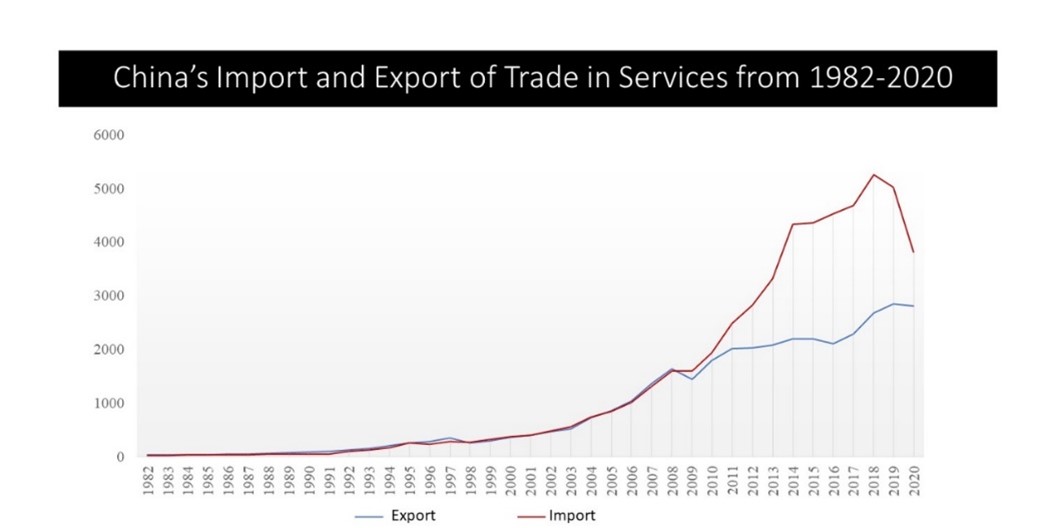

Discussions surrounding this transition inevitably involve the service sector, which can be divided into four subsectors: consumer services, distribution services, producer services, and social services. Although China has enjoyed a high surplus in trade in goods every year, it has also incurred huge deficits in services, indicating that its service sector is still relatively weak and uncompetitive in the global arena. Therefore, the service sector is in urgent need of improvement in China. Producer services, for example, include various support services for businesses, such as financial services, information transmission software and IT services, scientific research, and high-tech services. The development of the producer service industry is essential to support the thriving manufacturing industry in China. But how can we upgrade the producer service sector? I’d like to suggest three possible ways to facilitate this transformation.

Products as services

If manufacturing enterprises can change their mindset or business models when producing and selling products, they stand a good chance of turning conventional products into services.

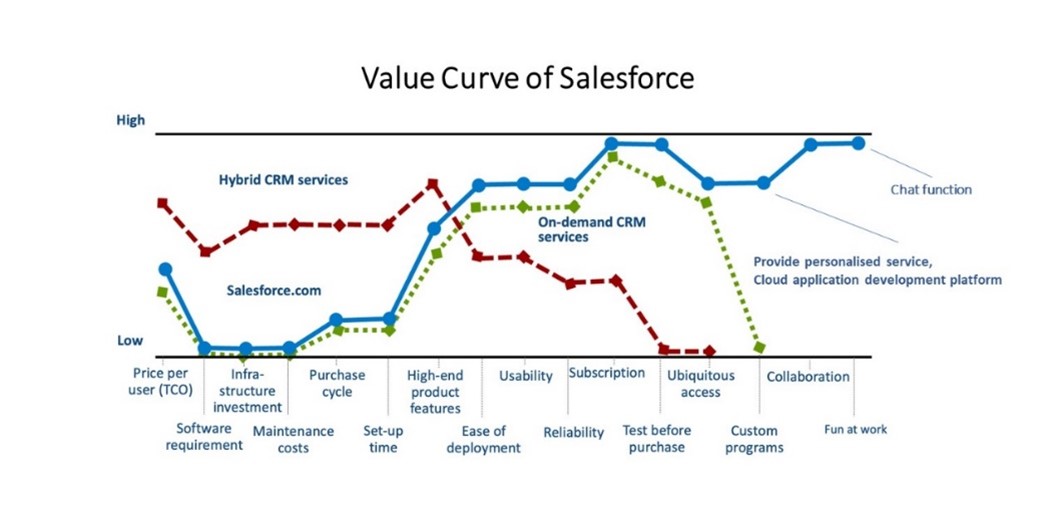

For example, Salesforce, an American cloud-based software company, revolutionised the traditional business model of software companies by launching the first Software as a Service (SaaS) CRM system in 2001. The web-based software, which lives on third-party servers, frees users from purchasing costly software, building IT hardware, and other maintenance responsibilities. To attract customers, Salesforce even offers a free trial period to entice companies to sign up for its services. This strategy has proven successful, and Salesforce became the first software company with an annual revenue of $1 billion in 2009, rendering it a typical example of the “product as a service” model.

Products + services

Offering “products + services” is another good way to render a business irreplaceable and enhance its competitive advantage. This model can be divided into two types: “products + complementary services” and “products + diversified services.”

In many cases, when customers buy a product, they need another product to accompany it to realise improved satisfaction. For example, potential buyers of electric vehicles will naturally be concerned about the number of charging stations in their local area. Similarly, the types and numbers of apps in the App Store will affect decisions surrounding mobile phone purchases. Taking Apple as an example, the apps in its App Store can be seen as complementary services that Apple offers, and these services will encourage more potential consumers to buy the company’s products while incentivising existing users to spend more on such services, thereby increasing users’ willingness to pay. Similarly, Apple’s iTunes Music Store represents yet another complementary offering for music players such as the iPod. These complementary services have become a new and important source of revenue for Apple, in that developers need to pay 15% to 30% to Apple in commissions. In 2020, Apple’s revenue from services alone amounted to $53.78 billion, with an annual growth rate of 16%.

Companies both large and small are always seeking to grow and develop. One method to achieve this is to extend companies’ existing products and abilities to other domains. Another method is to put themselves in the shoes of their customers and offer them a diverse range of products and services based on an understanding of existing customers to help companies achieve their goals by every means. For example, Man Wah Holdings Ltd., a manufacturer of recliner sofas, diversified into panel furniture and home decorations to offer customers a convenience service. The company sourced high-quality products from all over the world, such as crystal vases from the Czech Republic, and provided them to customers who purchased their recliners at a discount to make customers’ lives easier. This service mentality helps Man Wah to branch out to other related industry sectors, with the goal of developing new income streams and increasing customer loyalty.

Products + solutions

As an industry matures, services that used to be provided by three or four companies are often eventually provided by a single company. For users, this leads to more streamlined procedures and lower cost of use. For enterprises, this increases opportunities to interact with users and improve their loyalty and dependence. As an example, Salesforce launched its “Four Clouds” core products (Sales Cloud, Marketing Cloud, Services Cloud and Commerce Cloud) to cover all procedures before, during, and after sales following the SaaS CRM model it initiated in 2001. The Sales Cloud offers services such as sales forecasts, order tracking, and sales analysis; the Marketing Cloud enables enterprises to engage with customers via email, SMS, and ads on the same platform; the Services Cloud provides 24-hour cross-channel customer services; and the Commerce Cloud assists customers in building e-commerce platforms.

The “Four Clouds” system demonstrates that Salesforce is capable of generating a complete set of solutions for its customers, who can choose various service modules as needed. Such a method, which takes into account both completeness and flexibility, has contributed to better user experience and engagement. Since then, the company has expanded customer coverage by delivering vertical solutions following its presence in the healthcare, wealth management, banking, and consumption goods industries. One official report reveals that in fiscal-year 2021, vertical solutions brought the company an annual recurring revenue of around $2 billion, apart from a 30% higher unit price than general solutions, a customer loss rate as low as 3%, and more new users.

Another example is Baozun Commerce, a leading e-commerce solution provider in China. Founded in 2007, this fledgling company got its start by providing basic online operations services, and it has since developed into a professional end-to-end e-commerce solution provider, covering services such as online store operations, marketing, customer services, warehousing and distribution, as well as IT solutions. Its increasingly sophisticated solutions have led to greater consumer loyalty and more potential users. According to a report by Guoyuan Securities, by 2021 Q1, the company had secured 281 brand partners. In fiscal-year 2020, Baozun scored $55.7 billion RMB in gross merchandise volume (GMV), ranking first in the industry in terms of market share.

Two tips for service-oriented transitions

Service awareness

For both manufacturing and service companies, service awareness is indispensable for driving growth. As competition intensifies, differentiation will be critical for companies to maintain a competitive edge, and the best way to overtake opponents is to serve customers based on their needs. Whether they are selling products or services, companies can only hold appeal for customers by placing themselves in their users’ shoes.

One typical example is the US-based online shoe and clothing retailer Zappos. What made the company stand out is not its products, but, rather, the services it provides. To solve the problem surrounding the fact that online shopping is not as real as physical stores, Zappos photographed more than 1.3 million pairs of shoes from eight different angles to minimise cognitive bias. To improve delivery efficiency, Zappos built its warehouses near UPS warehouses, and it operates around the clock. The company also launched a 365-day free return and 90-day delayed payment service. Additionally, to better serve people with disabilities and other special needs, it has set up Zappos Adaptive, an business component featuring shoes with double zippers and shoes made for diabetics. Since July 2020, customers have even been able to buy a single shoe or a pair of shoes in different sizes. The core value of “Deliver WOW Through Service” has led to rapid and sustainable growth for Zappos. In 2004, the company became the largest online shoe seller, with sales of $184 million; in 2009, its sales revenue exceeded $1 billion; and in 2012, it was acquired by Amazon.com for $1.2 billion. What is even more remarkable is that Zappos has a 75% customer return rate. Other enterprises, such as Amazon.com and Nordstorm, have also been outperforming their peers by attaching greater importance to service.

Learn to leverage the strengths of others

Few enterprises can become strong all by themselves. They need to know how to make use of other professional partners to grow themselves, a skill that they must learn to further their development.

Strategic management often emphasizes the need for a company to realise its abilities and the limits thereof. For example, many corporate managers tend to believe that software development and online operation are piece-of-cake tasks that can be completed simply by having a team of IT engineers in-house. However, when these companies take a closer look at their core competitiveness, they may realise that software development is not their core competitiveness, and they lack the talent, the organizational routine, and the culture to successfully execute software development in-house. In such cases, firms need to leverage other companies’ core competencies to reach their goals in a more cost-efficient manner.

In other cases, if a company’s core competitiveness is R&D or design, instead of production, it would be advisable for these companies to outsource their production. A report by KPMG reveals that many daily tasks in international trade are labour-intensive, non-core activities, such as categorising import and export goods, which requires a great deal of repetitive work to code each product, as different countries and regions code the same product in different ways. This type of tedious activity is often outsourced to help companies focus on what they do best. Another example is the outsourcing of pharmaceutical R&D work, which is characterised by heavy inputs, long cycles, and high rates of failure. Therefore, pharmaceutical companies, especially domestic entities, will often outsource their R&D activities to companies that specialize in pharmaceutical R&D, such as WuXi AppTec. As such, outsourcing part of a job to professional agencies can not only reduce costs and improve efficiency, but can also help companies to focus on their areas of core competence to grow bigger and stronger.

Vivian Guo is an Associate Professor of Strategy and Entrepreneurship at CEIBS. For more on her teaching and research interests, please visit her faculty profile here.