Solutions for China’s Economic Survival

By CEIBS Professor of Economics & Finance

Xu Bin

Date written: September 4, 2018

In today’s China, where a number of changes have taken place and new status quo have emerged, future expectations for the macro-economy have changed significantly from previous ones. I believe that a Dominant Strategy (a game theory concept which involves utter confidence in your choices) is the solution to the current Chinese economic situation of "seeking out changes amid stable development". Read on for my analysis on China’s real estate & stock markets and its RMB exchange rate along with an outline of feasible solutions to challenges in those areas.

Real Estate Market

Stability of utmost importance; housing prices entering period of horizontal movement

I am neither optimistic nor pessimistic about China’s real estate market. In the foreseeable future, housing prices will gently decrease in some cities. However, it is unlikely that we will see the synchronized lowering of housing prices on a national scale. Housing prices will enter a period of horizontal movement with the introduction of a stabilization policy in the real estate market. I have two reasons for saying this:

1. The government has to stabilize housing prices in order to avoid systematic financial risk, that is a fact.

Over the years, the real estate market has had a great deal of money flowing into it, a result of limited investment options. I think of it as a lake whose water cannot flow outward because it is being blocked by a dam. In the case of the real estate market, the dam is capital control. In the latest crisis that hit in the second half of 2015, a large amount of capital flowed from China’s real estate and other markets into foreign countries. This occurred via various means, but behind it all was the tremendous public anticipation that the RMB would depreciate. The trend, though finally curbed through government intervention, provided a harsh lesson.

The ability to keep housing prices stable is an important prerequisite to prevent capital from flowing out of the real estate market. A significant drop in housing prices might trigger systematic financial risk. Hence, housing price stabilization will be a key component of the government’s housing policy for the foreseeable future.

2. High-quality economic development is inseparable from a reduced dependency on real estate.

The real estate market is now playing a very weak role in driving economic growth. Besides, real estate development is contrary to the government's medium to long-term strategy of destocking, deleveraging and promoting supply side reform. Therefore, the government has a strong incentive to implement a policy of "resolutely curbing the rise in housing prices".

For the reasons outlined above, I believe that future housing prices will remain within a relatively stable range and we are unlikely to see a sharp rise or fall.

There are indeed big bubbles in China's real estate market now, but an asset price bubble is a widespread global phenomenon, rather than a China-specific problem. The asset price bubble can be explained by global liquidity surplus, which is a result of the common practice of over-issuing currency; since the collapse of the Bretton Woods system in 1973, many countries have lost a vital anchor that previously influenced their decisions on issuing currency. The resulting excessive liquidity pushes up housing price once it enters the real estate market. China is not the only country where this has happened; America, Canada and many European countries also experienced several rounds of housing price increases.

In comparing the housing prices of Beijing and Shanghai with those of Tokyo and New York, one may find that the former are not ultra-high at all. In fact that there is still room for housing prices to rise in those Chinese cities. As the real estate markets of Beijing and Shanghai are geared towards attracting high-end purchasers from all over China, or even the world, it is not reasonable to evaluate housing prices of the two cities by looking at the average income of native residents. For houses in prime locations in first-tier cities such as Beijing and Shanghai, there is still a potential for appreciation in the future.

As to bubbles in the real estate market of non first-tier cities in China, they can only be slowly absorbed through future development in the real economy and an increase in people's income. It is the hope of the general public that the real estate market returns to rational development.

Stock Market

Huge risks exist; private investors need to be cautious

The stock market is risky, especially for private investors. My advice is that investors need to be cautious. I suggest that they keep a distance from the stock market.

In the past ten years, a huge amount of capital has flowed mainly to the real estate market rather than the stock market. The latter has failed to attract a continuous inflow of investment due to a lack of public confidence in it.

In 2013, under the government's initiative of "letting the market play a decisive role in resource allocation", investors had a good opinion of the stock market and were optimistic about its future. At that time, I speculated that the stock market would rise in 2015. It did indeed rise starting from late 2014, but there was a sharp drop after a sharp rise as the stock price increased at a speed far greater than normal in the first half of 2015. This dealt a great blow to people's confidence in the stock market’s future.

When A-shares were included in the MSCI Index, many investors were expecting good results. To their disappointment, the stock market did not go up. Under the cloud of such bearish factors as the current Sino-US trade friction, the stock market is in a continuous decline. Though it rebounds occasionally, such rebounds are not reliable in my opinion.

The majority of investors in China’s stock market are individual investors, who do not have sufficient capital to invest in such high-threshold assets as real estate. They enter the stock market seeking to maintain or increase the value of their assets or to make a fortune by gambling. But generally speaking, the stock market is a zero-sum-game. Private investors, who are less skilled, compared to institutions, when it comes to grasping structural opportunities, are reduced to being merely victims.

How can we solve this dilemma? As I see it, the Chinese government needs to open its domestic financial market, encourage the development of private finance and support the market in launching quality investment products, in order to better satisfy the investment demands of ordinary people. Against the current background of consumption upgrading, there is a huge demand being generated in the area of consumer finance. If the domestic financial market is open enough, quality financial investment products will be developed for consumers, which can benefit both them and investors.

Considering the current economic situation, I support the government's reinforced efforts at capital control, on the capital that is flowing outward, to be more precise. China should further open its domestic financial market to both foreign and private capital. According to the economic theory of “optimal sequence for reform and opening-up", a country’s reform and opening up should be carried out by first opening up foreign trade, then reforming the domestic financial market and, finally, opening up to cross-border financial capital flows. The current focus is on reforming the domestic financial market.

It is undeniable that government plays a lead role in the development of the financial market. But the market should be given a much more significant role. Market force is the basic driver for innovation and development. Many of today’s successful enterprises such as Alibaba and Tencent are the outcome of market needs, instead of government planning. As for the domestic financial market, the government should allow it to develop naturally. Only when the financial service industry is market-oriented enough, can we see a good solution to a number of current financial problems – including those in the stock market.

Exchange Rate

Stable in short term; room for depreciation in medium term

The RMB exchange rate is currently a big concern within the wider public. In my opinion, chances are slim that the exchange rate of RMB against USD will break through the bottleneck of “7:1” in 2018. The trend in the RMB exchange rate in the next year or two remains to be seen. But there is still room for the RMB to depreciate in the medium term.

Over the past few years, we observe a stable pattern between the RMB exchange rate and the US dollar index. The RMB had appreciated/depreciated against the US dollar when the US dollar index dropped/rose, or in other words, when the US dollar depreciated/appreciated against all other currencies combined. Moreover, the degree of RMB appreciation/depreciation against the US dollar had been smaller than the degree of overall depreciation/appreciation of US dollar against all other currencies combined.

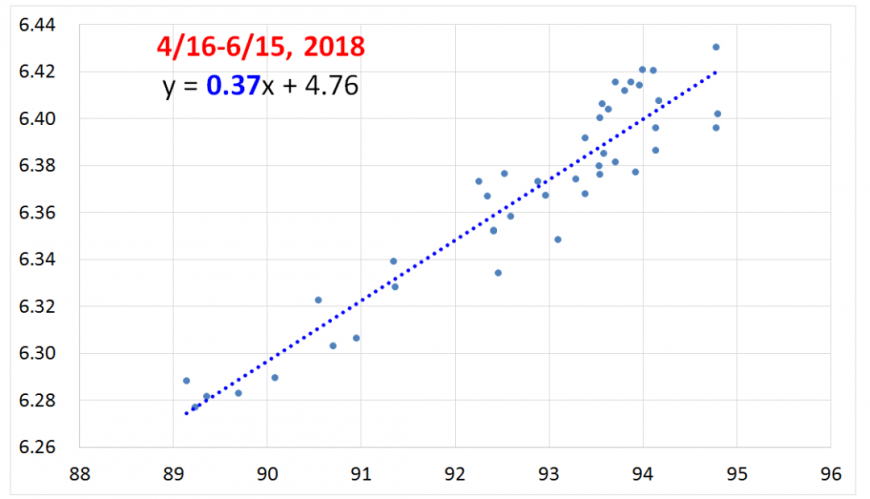

This pattern between RMB exchange rate and the US dollar index was maintained up to mid-June of 2018. Using data of the US dollar index and the mid-rate exchange rate of RMB against US dollar in the period from April 16 to June 15 of 2018, I arrive at an estimated elasticity of 0.37 for the RMB exchange rate against US dollar index. The figure suggests that with every 1% rise in the US dollar index, the RMB depreciated against the US dollar by only 0.37% (see figure below); that's to say the depreciation of RMB against US dollar is less than the overall appreciation of US dollar against all other currencies combined.

Note: The horizontal axis shows US dollar index and the vertical axis shows the mid-rate of the exchange rate of RMB against US dollar. The estimation uses the natural logarithm of the two variables. “y” in the regression formula is the natural logarithm of the exchange rate of RMB against US dollar (multiply by 100), “x” is the natural logarithm of US dollar index. Hence the estimated coefficient of x is the elasticity of the exchange rate of RMB (versus the US dollar) against the US dollar index. The estimated point elasticity during the period from April 16 to June 15 of 2018 is 0.37.

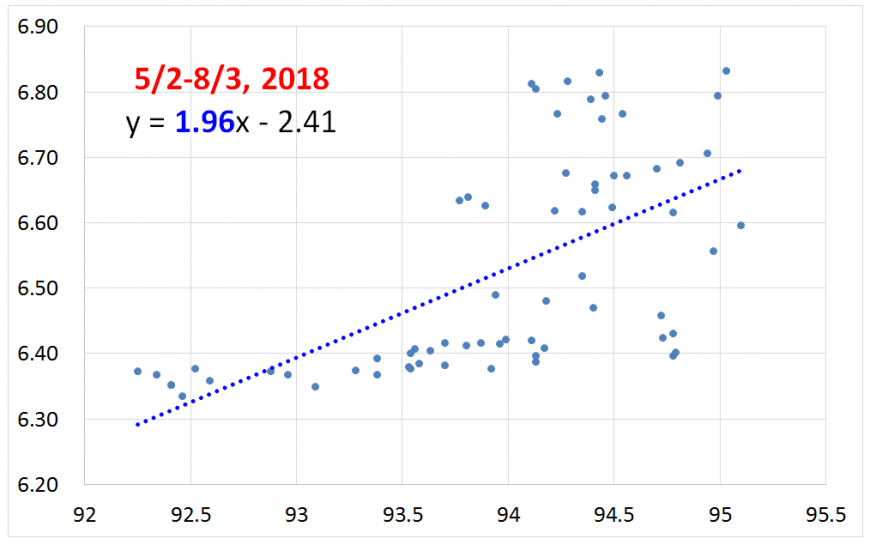

However, the pattern changed in the second half of this year: the RMB depreciated at an accelerated rate against the US dollar. The estimated elasticity of the mid-rate of RMB exchange rate (versus the US dollar) against the US dollar index, based on the data for the period from May 2 to August 3, was 1.96. In other words, in recent months, with every 1% rise of the US dollar index, the RMB depreciated against the US dollar by 1.96% (see figure below). That's to say, the depreciation of RMB against US dollar was far greater than the overall appreciation of US dollar against the other currencies combined.

Why did the RMB depreciate at an accelerated rate against the US dollar in the second half of this year? I believe that this phenomenon is closely related to the changed situation of confrontation in Sino-US trade. In analyzing such financial variables as housing prices, stock prices and exchange rates, I will always follow the adage that "trends are determined by the economy, turning points are dependent on politics". The fluctuation in housing prices, stock prices and exchange rates is ultimately determined by economic factors. They will eventually rise or fall because of such factors. However, it is hard to say when the rise or fall starts by merely judging from economic factors. In many cases, it is significant political events that create a turning point.

In 2016, the US dollar index, which had overshot beyond the level determined by fundamentals, was expected to drop. However, the drop did not come until Donald Trump took office unexpectedly, and advocated for a weak US dollar; this was the reason the RMB exchange rate against the US dollar reversed its downward trend and began to rise in 2017. Entering 2018, the US economy showed a strong performance exceeding expectation, which laid an economic foundation for another round of US dollar strengthening.

With continuing consultation between China and America from April to June of 2018, China reined in RMB depreciation, which is evident from statistical data that shows a smaller elasticity of RMB exchange rate against the US dollar index. However, as the negotiations had yielded little results entering June, and with the levying of tariffs, it became much less likely that any breakthroughs would be made in Sino-US trade negotiations this year. As a result, from mid-June, China started to adopt a strategy of accelerating RMB depreciation as the political constraints of such a move temporarily disappeared. From statistical data, this is evident from a great elasticity in the RMB exchange rate against the US dollar index.

In my opinion, accelerated RMB depreciation, which is a part of the planned response to the US’ trade policy toward China, can alleviate the negative effects of the additional tariffs imposed by the US on Chinese exports.

However, the trend of accelerated depreciation of the RMB is not likely to continue in the next few months, as the bottleneck – that 7:1 exchange rate of RMB against US dollar – is psychologically such a difficult barrier to overcome. As mentioned above, once there is an expectation that the RMB will continue to depreciate, there will be acceleration in capital outflow, as was the case in the second half of 2015. If the exchange rate of RMB against US dollar breaks through the bottleneck of "7:1" this year, this would reinforce the expectation for RMB depreciation, which is against the current government policy priority of stabilizing the economy and the exchange rate.

Hence, it is rather unlikely for the exchange rate of RMB against US dollar to exceed "7:1" in 2018. And the elasticity of RMB exchange rate against US dollar index will see a decline in the next few months. But in the medium term of two to three years, the exchange rate of RMB versus the US dollar has room for depreciation. According to the interest rate parity condition, as China’s interest rates are higher than those of the US, RMB would tend to depreciate against US dollar to remove arbitrage opportunities for benefiting from both higher interest rates and higher exchange rates. Due to this financial market condition and possibly an intensified slowdown of the real economy, some time within the next two or three years, the exchange rate of RMB against US dollar may break through the bottleneck of "7:1". Beyond this medium term, the trend of the RMB exchange rate will depend on the future performance of the Chinese economy.

Solutions

Reduce taxes and administrative fees; stick to a Dominant Strategy

During a CEIBS alumni forum held in late 2013, I offered a few conjectures, one of which was that China's economy may be faced with the risk of high inflation starting from 2018. This is because China’s macroeconomic policy formation is “path-dependent”, the path being sufficiently high economic growth rates. I suspected that China’s growth rate would drop to an "unacceptable" level in/after 2018, which would induce a new round of monetary easing whose effect would show in consumer goods prices in terms of high inflation.

It seems that my prediction was right. The government has recently started to ease the macroeconomic policy. With the real estate market under control, the downward trend of the stock market, the depreciation of RMB exchange rates, and against the background of consumption upgrading, it is foreseeable that the eased macroeconomic policy will result in excess demand for consumer goods and push up inflation.

What should we do, within the economic policy context of "seeking changes amid stable development"? I think we should "seek stable development by making changes". How can we make changes? The answer lies is adopting a Dominant Strategy. This is a basic concept in game theory, which means that the player of a game has a strategy that is the best for him, compared to whatever strategies are selected by his rivals in the game.

What is the Chinese economy’s Dominant Strategy? The answer is to let the market play a decisive role in resource allocation. No matter how the domestic or international situation changes, China’s economic development will always have a bright future as long as its people fully unleash their wisdom and potential. How can they do this? The key is to provide them with sufficient room to develop freely. Both economic theory and practice prove that a market-oriented economy is the most efficient way to fully unleash people's wisdom and potential.

It is unwise for us to stimulate economic growth by sticking to the method of adding to fiscal expenditure. As is well known, there are two tools of expansionary fiscal policy: increasing government expenditure and reducing tax. In the past, we have been using the government expenditure tool to stimulate economic growth; the tax tool, however, has never been used in a real sense. Although the government has introduced policies on tax reduction and has implemented such policies in some areas, there has arguably not been much real alleviation of tax burdens on the private sector, as government tax revenue continues its rapid increase.

According to the latest statistics released by the Ministry of Finance, there has been a year-on-year increase of 14% and 20.6% for national tax revenue and individual income tax revenue, respectively, from January to July of this year. Revenue from individual income tax has reached RMB922.5 billion, twice that of 2014. Tax revenue has risen much faster than per capita disposable income and GDP, which will surely have an adverse effect on economic development.

It's high time that we reduce taxes, whose high rates place a heavy burden on many enterprises. In the short run, tax reduction can offset part of the negative impact that the deterioration in Sino-US trade relations has had on domestic enterprises. In the medium and long term, it can be a driving force for innovation and entrepreneurship, which are key to sustainable economic growth.

The government must have great resolve in its efforts at tax reduction. It will need to deepen reform of the institutional and administrative systems in order to stem the huge demands of administrative expenditure. The vitality of both the supply and consumption sides cannot be kindled until the vested interest in government institutions is overcome, tax and administrative fees are reduced, and wealth is reallocated from the government to the public.

In short, if China is to survive the current volatility and turmoil, the market has to play a greater role in resource allocation, a larger space needs to be created for people to unleash their wisdom and potential, and greater efforts are needed in implementing reductions in tax and administrative fees as well as administrative system reform. This is not only a Dominant Strategy for coping with the current international situation, but also a prerequisite for the Chinese economy to maintain stable and sustainable development in the years ahead.