Financial Statements Interpretation for Decision-makers Programme

Date: November 12-15, 2026

Venue: Shanghai

Participants

This programme is designed for non-financial middle/senior managers whose work involves financial statements interpretation.

Introduction

Highly profitable companies won’t go bankrupt; fast-growing companies won’t have to address cash flow problems; companies won’t face insolvency as long as they still own assets; companies may inject their retained earnings into investment projects. If you agree with any of the statements above, you are strongly urged to update your financial expertise as soon as possible, as these are all common misconceptions held by many executives with a non-financial background (and even by some financial professionals).

Financial statements are not only filled with information valuable to executives, but also fraught with ambiguous subtexts or even hidden pitfalls that are aimed at misleading them. To better interpret a company’s financial statements, executives need to probe into its operating patterns and business strategy and the accounting policy and procedures for financial statements preparation. This programme aims to help participants without a financial background discuss how financial statements reflect business operation in the internet age in light of external factors (e.g., economic landscape, industrial patterns, and effectiveness of monitoring and auditing), and understand and analyze a company’s financial statements based on its business model so as to assess its historical performance and make a sound decision on its future development and value creation.

Programme Coverage

- Financial Statements Analysis

- Impact of Capital Market on Financial Reporting

- Assets Analysis

- Liabilities and Shareholder's Equity

- Revenue Recognition

- Cash Flow Statement Analysis

- Income Statement Analysis

- Analyzing financial data to understand the factors that affect a company’s profitability

- Making a sound decision on a company’s future development and value creation

A certificate of completion will be awarded

Contact Us

Shanghai

Tel: (86 21) 2890 5187

Email: exed@ceibs.edu

Address: 699 Hongfeng Road, Pudong, Shanghai

Beijing

Tel: (86 10) 8296 6688

Email: exed@ceibs.edu

Address: Building 20, Zhongguancun Software Park, 8 Dongbeiwang West Road, Haidian District, Beijing

Shenzhen

Tel: (86 755) 3699 5199

Email: exed@ceibs.edu

Address: 142 Zimao St., Qianhai Cooperation Zone, Shenzhen, P. R. China 518066

Programme Objective

This programme aims to help participants interpret, understand, and analyze a company’s financial statements based on its strategy and in light of external factors (e.g., economic landscape, industrial patterns, and effectiveness of monitoring and auditing) so as to assess its historical performance and predict its future prospects. We will adopt a user’s perspective, because most business professionals are users of financial statements, internally (e.g., managers and executives) or externally (e.g., investors and analysts), rather than preparers.

Programme Benefits

The programme will help participants to:

- Communicate more effectively with their finance department

- Learn different “tools” for financial statements analysis

- Properly assess a company’s business performance and its market value

- Understand critical operating and strategic issues beneath seemingly boring financial data

- Analyze financial data to understand the factors that affect a company’s profitability

- Make a sound decision on a company’s future development and value creation

Programme Schedule

Day 1

Introduction

- Programme Introduction

- Framework for Financial Statements Analysis

Financial Markets and Reporting

- Impact of Capital Market on Financial Reporting

Day 2

Assets Analysis

- What is an Asset?

- Significance and Types of Assets

- Nature of Assets

Liabilities and Shareholder's Equity

- Liability is a Risk

- Shareholder’s Equity and Enterprise Value

Day 3

Revenue Recognition

- Matching Principle

Cash Flow Statement Analysis

- Cash Flows from Operating Activities

Income Statement Analysis

- Analyze a Company through its Financial Statements

Day 4

Financial Planning for Corporate Growth

- Corporate Growth and Demand for Funds

- Estimation of Demand for External Financing

Corporate Valuation and Value Creation

- Determinants for Corporate Valuation

- Multiple Valuation

- Discounted Cash Flow Valuation

We reserve the right to adjust the course information (including price, date, location, faculty, course arrangement and other details)

CEO

Yantai Wanhua Polyurethanes Co., Ltd.

President

Wanbang Pharmaceutical Marketing and Distribution Co., Ltd.

Partner

Shanghai Shangwei Lawyer Office

Vice General Manager

High Hope Int'l Group Jiangsu Woollen Knit & Garmtex Imp & Exp Corp Ltd.

General Manager

Shenzhen Energy Logistics Co., Ltd.

Teaching Language

Chinese

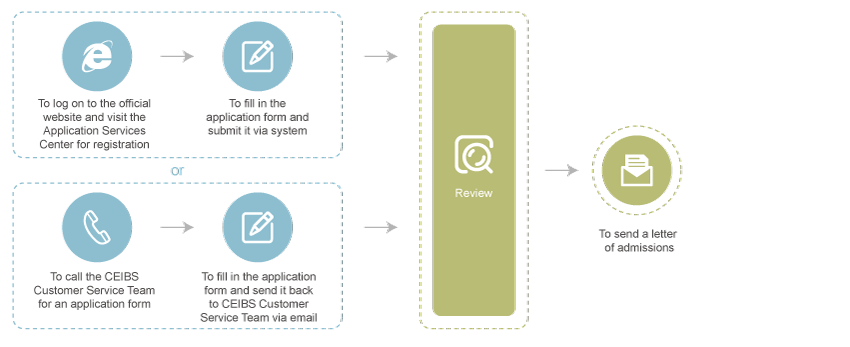

Admissions Procedures

Applications are requested at least 30 days before the programme start date. Applications are reviewed as they arrive and admissions are subject to the final confirmation of CEIBS. Any applications received after that date will be considered on the basis of space availability. For more information, please contact our Customer Service Team in Shanghai, Beijing or Shenzhen.

Cancellations

Any cancellation made 30 days or more prior to the programme start date is eligible for a full refund of programme fees paid. However, the expenses arising therefrom shall be for the account of the applicant or his/her employer. Any cancellation made less than 30 days prior to the programme start date shall be subject to a fee of 20 percent of the total programme fee. After the programme starts, no fees shall be refunded for participants who withdraw from the programme for any reason.

Notification

To ensure the continuity of your learning, you are required to make proper arrangements according to the course schedule after receiving your letter of enrollment. We will neither make up lessons for you nor confer you with the certificate of completion if you are absent from the course for personal reasons. CEIBS reserves the right to amend information on this programme including price, discount, date, location, faculty, daily schedule and other details.