Shanghai ranks seventh among world's top asset management centres

September 3, 2024. Shanghai – Shanghai ranks seventh among top global asset management centres with a grade of 85.1 points, according to the 2024 Global Asset Management Center Index Report released by the CEIBS Lujiazui International Institute of Finance (CLIIF) today.

New York, London, and Chicago ranked as the top three global asset management centres, followed closely by Frankfurt and Paris. Due to the slowdown in capital flows in Asia, Singapore, Shanghai, and Tokyo have all dropped one place compared to last year, ranking sixth, seventh, and tenth, respectively.

Among six sub-sectors, New York tops the list in terms of Underlying Assets, Asset Management Institutions and Open-End Funds, while Shanghai offers a greater growth rate than London.

Speaking at an event to mark the release of the Report, CEIBS President Wang Hong highlighted the need for Shanghai to step up its efforts in five key areas: establishing a client-centric product service system, accelerating intelligent and digital transformation, expanding the opening-up of the asset management industry and enhancing the capacity of global resource allocation, advancing ESG and sustainable investments, and cultivating and attracting top talent in the asset management sector.

President Wang also noted that, as a world-leading international business school rooted in China, CEIBS has long been committed to nurturing business leaders versed in “China Depth, Global Breadth”, and over the past 30 years has continuously enhanced its knowledge creation capabilities and developed pioneers and leaders in emerging financial fields. CLIIF, as a key financial think tank launched by CEIBS, is a high-level research institution for the development of Shanghai as an international financial centre, and continues to study issues at the forefront of Shanghai's financial development, she added.

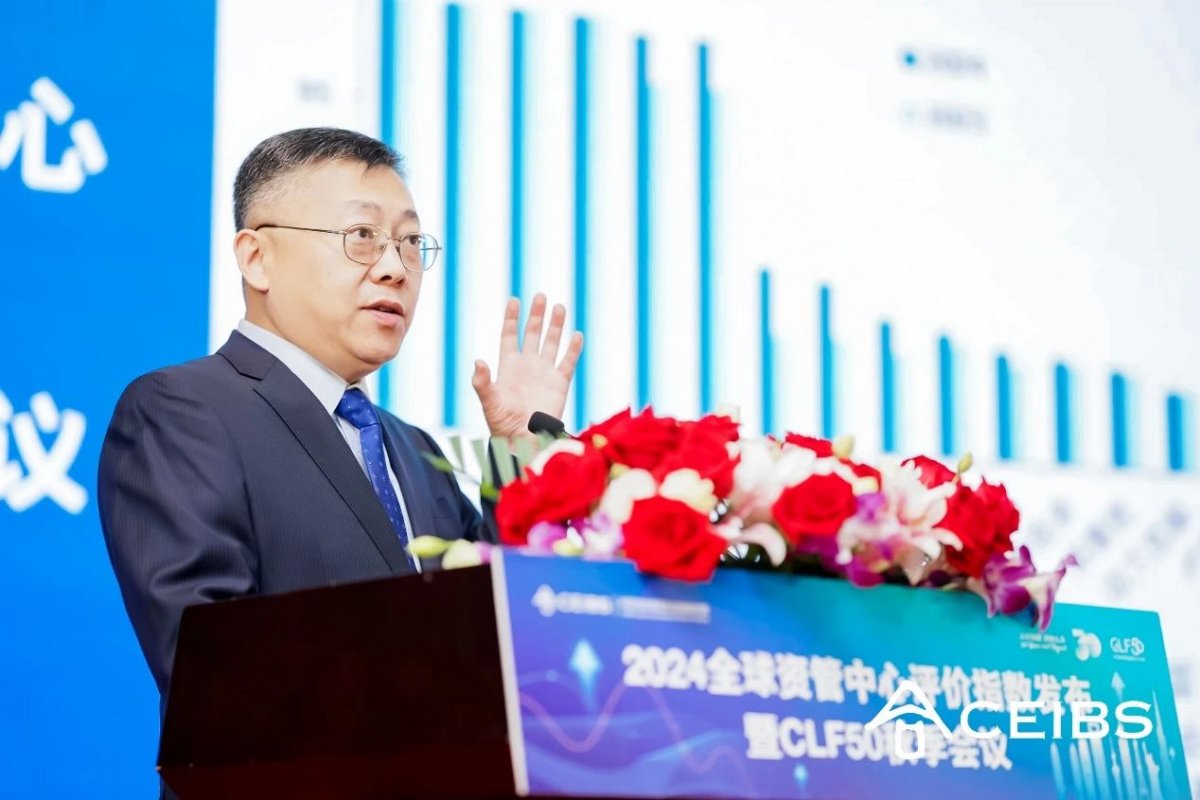

In a keynote speech, CEIBS Adjunct Professor of Finance, CLIIF President, and Former Chairman of ICBC Jiang Jianqing pointed out that AI plays an increasingly important role in asset management, particularly in reducing costs, improving operational efficiency, optimising product development, and advancing marketing.

However, although AI brings many new opportunities in asset management, we need to be aware of data security and privacy protection, he added. “The application of AI in asset management is an irresistible trend, which not only improves business efficiency but also opens up a new development direction for the asset management industry. However, safety must come first in the development of the industry to address the risks posed by the technology.”

Also speaking during the event, Director of the Lujiazui Administration of the Shanghai Free Trade Zone Xiao Jian stated that the index is a crucial part of the financial industry's ecosystem, providing professional guidance and reference on the current state, trends, and further direction of the asset management industry.

“In the future, the Lujiazui Financial City will actively coordinate resources, build platforms, enhance functions of core areas, and promote the upgrading of the regional capacity to strengthen its international influence,” Xiao said.

Ye Guobiao, Chairman of the Board of Directors of Shanghai Securities News, emphasised that Shanghai, in ranking among the top ten global asset management centres, bears the responsibility of driving financial innovation and development. He then outlined the necessary conditions for a true global asset management centre: security, freedom, and efficiency.

“The development of an asset management centre is inseparable from specialised and international asset management institutions and professional talent. CEIBS has made significant contributions to the construction of Shanghai as an international financial centre in terms of cultivating international business leaders and creating and disseminating knowledge,” he added.

CEIBS Professor of Finance and Accounting and Executive Deputy Director of CLIIF Zhao Xinge suggested that the index, which has been published for four consecutive years, provides us with valuable insights into the development trends of China's asset management industry.

“Despite global economic uncertainty and market volatility, Shanghai still ranks high in the world in terms of the growth rate of the asset management scale and boasts advantages in digital assets and ESG business,” Prof. Zhao said, adding that Shanghai has a long way to go to become a top global asset management centre with promising prospects for the future.

CEIBS Adjunct Professor of Economics and Finance Sheng Songcheng also delivered a keynote speech during which he highlighted that Shanghai’s main economic challenge derives from insufficient consumer demand. He suggested various fiscal and monetary reforms to stimulate consumption, including tax reforms, special treasury bonds for consumption, and incentives for local governments to promote consumption.

Yang Chengzhang, Chief Economist of SWS Research, emphasised that new productivity requires financial services to adapt to changing needs and structures. He explained that this new type of productivity focuses on qualitative changes and puts innovation as the key driver, which requires breaking the boundaries of innovation, value, and factors.

He further stressed the need for innovative financial frameworks that support enterprises' new financial structures. As economies transition, financial preferences shift towards more stable returns and risk aversion, leading to changes in asset expansion paths. He highlighted that financial institutions must now focus on balancing both scale and quality in asset growth, transforming their approach to better align with the needs of the modern economy.

The conference concluded with a panel discussion moderated by Vice Chairman of CLIIF Liu Gongrun and featuring leading industry experts, including Chief Economist at Guotai Junan Securities He Haifeng, General Manager of Ping An Asset Management Luo Shuiquan, Managing Director of PGIM Sun Hao, and McKinsey & Company Senior Partner Qu Xiangjun, on the topic of ‘Challenges and Solutions of the Asset Management Industry under New Circumstances’.

Download the full 2024 Global Asset Management Center Index Report here.